Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

DEV FOR 2025 / 2026

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

DEV FOR 2025 / 2026

About Me

Rachel Smith

Rachel Smith At Prime Learning, we are committed to empowering individuals and organizations through high-quality, industry-focused compliance training solutions. Our expert-designed courses cover essential topics like compliance, leadership development, workplace ethics, and professional skills, helping businesses stay competitive and employees thrive in their careers. With a focus on innovation, flexibility, and engagement, Prime Learning delivers interactive and practical learning experiences tailored to today’s dynamic workforce. Whether you're looking to enhance compliance knowledge, upskill your team, or improve workplace efficiency, we provide the tools and expertise you need for success.

Rachel Smith -

Thu at 6:20 AM -

Other -

education

Human Resource

best payroll service

compliance training

Form 941 IRS Compliance

-

33 views -

0 Comments -

0 Likes -

0 Reviews

Rachel Smith -

Thu at 6:20 AM -

Other -

education

Human Resource

best payroll service

compliance training

Form 941 IRS Compliance

-

33 views -

0 Comments -

0 Likes -

0 Reviews

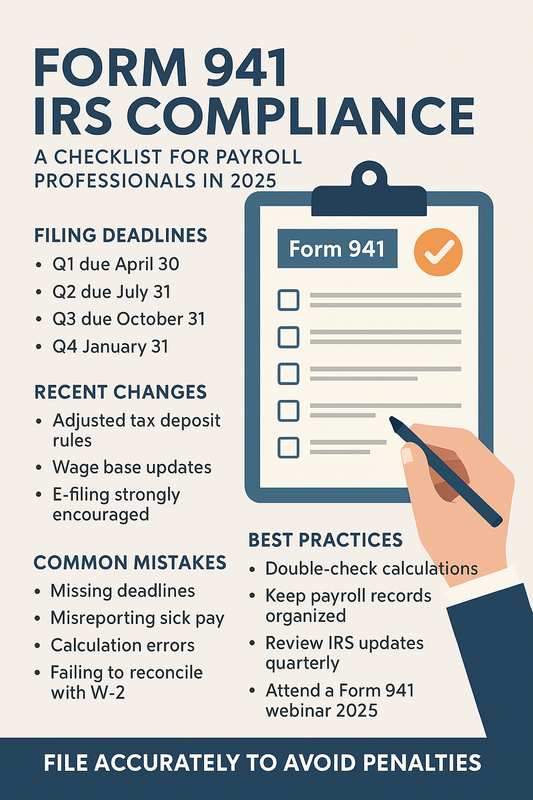

It’s a new year, and for anyone in charge of payroll, that means one thing — new IRS rules, new forms, and new chances to mess something up. But don’t worry — we’re here to make Form 941 IRS Compliance in 2025 a whole lot easier.

This isn’t just another form. It’s your quarterly obligation to the IRS, and getting it wrong can cost your business hundreds — even thousands — in penalties.

Let’s walk through how to file it right and keep the IRS off your case.

Form 941 reports federal payroll tax info every quarter. It’s how you let the IRS know:

It’s a crucial form for Payroll Professionals and a required checkpoint for every employer.

Filing isn’t the hard part. Staying compliant is. That’s because in 2025, the IRS is cracking down on:

They’ve even increased staffing to audit more businesses. Translation: Don’t wing this.

✔ Automate payroll reporting

If you’re still using spreadsheets, now’s the time to upgrade. Today’s payroll software handles wage base limits, credits, and deadlines automatically.

✔ Sync with your W-2s early

The #1 reason for IRS letters? 941s that don’t match your W-2s. Double-check everything — every quarter.

✔ Know the deadlines by heart

|

Quarter |

Deadline |

|

Q1 |

April 30, 2025 |

|

Q2 |

July 31, 2025 |

|

Q3 |

October 31, 2025 |

|

Q4 |

January 31, 2026 |

Don’t wait until the last minute. You’ll thank yourself later.

The Form 941 webinar 2025 is packed with everything you need to know in one place:

Think of it as your annual tune-up — but for taxes.

Here’s what to stop doing in 2025:

Each of these can lead to penalties — or worse, audits.

Whether you handle payroll yourself or have a third-party provider, your business is still on the hook for getting Form 941 IRS Compliance right.

So do it once, do it right, and use the tools that make it easier.

✅ Stay ahead of updates

✅ Automate where you can

✅ Train your team

✅ Sign up for the Form 941 webinar 2025

✅ And breathe easier knowing your tax house is in order