Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

DEV FOR 2025 / 2026

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

DEV FOR 2025 / 2026

About Me

Latinos Media

Latinos Media Latinos Media provides all types of news feeds on a daily basis to our Members

Posted by - Latinos Media -

on - May 10, 2023 -

Filed in - Technology -

-

467 Views - 0 Comments - 0 Likes - 0 Reviews

A startup backed by Sam Altman says it’s on track to flip on the world’s first fusion power plant in five years, dramatically shortening the timeline to a carbon-free energy source that’s eluded scientists for three-quarters of a century.

Helion Energy’s announcement that it’s on the verge of commercializing the process that powers the sun is an astounding claim—and a questionable one, according to several nuclear experts. That’s mainly because the company hasn’t said and won’t comment on whether it’s passed the first big test for fusion: getting more energy out of the process than it takes to drive it.

Nevertheless, the 10-year-old company, which is based in Everett, Washington, has already lined up its first customer for the planned commercial facility, striking a power purchase agreement with the software giant Microsoft. Helion expects that the plant will be built somewhere in the state of Washington, go online in 2028, and reach its full generating capacity of at least 50 megawatts within a year.

That’s small as power plants go: the generating capacity of a typical US natural-gas plant is now well over 500 megawatts. But if Helion pulls it off, it would be a big deal: economical commercial fusion plants could deliver a steady stream of clean electricity, without the intermittency challenges of solar and wind power or the controversies and concerns associated with the technology’s nuclear cousin, fission. It could make it cheaper and easier to eliminate the greenhouse gases driving climate change from the power sector, and it would help meet soaring electricity demand as the world races to cut pollution from transportation, homes, office buildings, and industry.

Other fusion startups are aiming to begin operating power plants in the early 2030s, and plenty of observers think even those timelines are overly optimistic.

Unless Helion has made some major advances that most organizations would have trumpeted, the company still faces a series of very difficult technical tasks, says Jessica Lovering, executive director of Good Energy Collective, a policy research group that advocates for the use of nuclear energy.

That includes producing more energy than the process uses—and converting that energy into a consistent, affordable form of electricity that could flow onto the grid.

“So there are two big unproven steps,” says Lovering, adding that she is “skeptical of the technological readiness.”

Adam Stein, director of the Nuclear Energy Innovation program at the Breakthrough Institute, also thinks that Helion still appears to face some big technical obstacles.

“That doesn’t mean it’s impossible, but it’s also not the steady march toward victory that is often portrayed,” he says. “These are breakthroughs we’re talking about.”

Getting to gainTo date, only one research group, Lawrence Livermore’s National Ignition Facility, has achieved what’s known as “scientific net energy gain”—meaning, in that case, that it produced more energy from fusion than was delivered through the 192 lasers used to trigger the reactions. That milestone was reached late last year.

The experiment did not, however, achieve what’s known as “engineering gain,” which takes into account the total energy used to power up the lasers and otherwise drive the process. Getting to that point is essential for developing practical commercial fusion systems, experts say. (Meanwhile, the lab hasn’t managed to repeat the feat so far.)

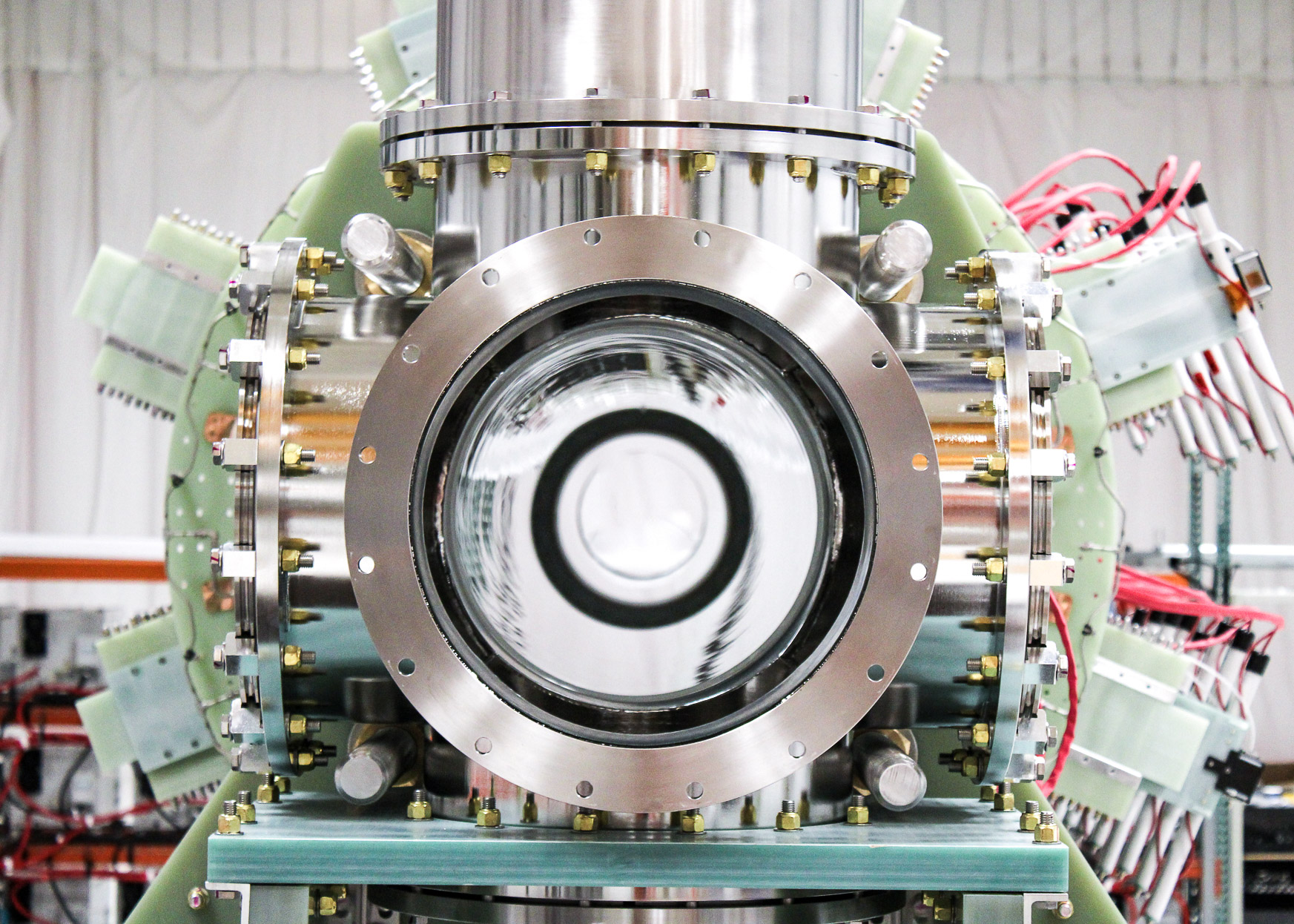

A Helion engineer prepares for a pulsed power test.

A Helion engineer prepares for a pulsed power test.

In 2015, David Kirtley, the chief executive officer of Helion, told me he believed the company could achieve “scientific gain” in the next three years. When asked again this week whether the company has achieved scientific or engineering gain, or when it expects to, Helion declined to comment, citing competitiveness issues. The company said the “initial timeline projections” assumed it would be able to raise funds faster than it did.

On top of the technical challenges, Helion will also need to plan, license, and build its commercial plant even as the US Nuclear Regulatory Commission is finalizing details of how it will oversee the nascent sector.

But Kirtley stresses that the company, which employs nearly 160 people, is taking an approach that sidesteps some of the obstacles other research groups and startups face. He also says that it has already made significant advances.

Helion has developed and tested six prototypes to date. It announced in 2021 that the latest, dubbed Trenta, reached temperatures of more than 100 million ˚C, making it the first private company to publicly reveal it had achieved the temperatures necessary for a commercial plant. The company is now building a seventh, Polaris, that it expects will demonstrate the ability to produce electricity from the reactions next year.

“Given the history of fusion, we understand that there will be skepticism, and we believe that skepticism is healthy,” Helion said in a response to MIT Technology Review.

“The results and progress of our 6th prototype give us great confidence that our timeline is realistic and that we can build the first fusion power plant by 2028,” the statement continued.

Plasma and pulsesWhile the fission reactions that power traditional nuclear power plants split atoms apart, fusion works by forcing them together, under extremely high temperatures, to overcome the usual repulsive forces of atoms in close proximity. That produces a new atom minus a little bit of mass, the loss of which generates a whole lot of energy.

Most other labs and startups rely on powerful lasers or doughnut-shaped machines surrounded by powerful magnets, known as tokamaks, to create the conditions in which a sustained series of fusion reactions can occur—a condition known as ignition. But Helion is developing what it calls a “pulsed non-ignition fusion system,” which only requires fusion to take place for short periods.

The company’s device is a six–by-40-foot barbell-shaped “plasma accelerator.” It uses powerful magnets to heat a gas mixture to the point that the atoms break apart, creating rings of an ultra-hot state of matter known as plasma on either end of the device.

The magnets then propel those rings at each other at a million miles per hour, and further compress them in the middle of the device, which creates those temperatures of more than 100 million ˚C, the company says. That triggers fusion reactions, in which nuclei collide, protons and neutrons combine, various particles are released, and energy is produced.

Other fusion approaches would require an additional step to convert that energy into electricity, through conventional methods like warming water or other working fluids into a gas that turns a turbine. But Kirtley says Helion’s process can recover electricity directly.

As the plasma continues to heat and expand, its own magnetic fields push against those created by the magnets surrounding the device. That drives a flow of charged particles, otherwise known as an electric current, through the adjacent electromagnetic coils. And that, in turn, recharges an energy storage device known as a capacitor, which powers up the magnets, readying them to deliver the next pulse.

To work as a power plant, Helion’s device will need to produce energy on top of what’s required for the pulses. That additional energy would be then converted into alternating current and routed onto the grid.

The planned commercial generator wouldn’t need to be physically larger than Helion’s latest prototype, but it will require additional systems for cooling, electricity connections, and other purposes, Kirtley says.

“Engineering challenges”Paul Wilson, a professor of nuclear engineering at the University of Wisconsin Madison, says it would “surprise” him if a commercial fusion plant was up and running in 2028. But he says it “would be exciting” if it did occur.

He agrees that there are inherent advantages in Helion’s approach, but he also notes some sharp trade-offs.

The easiest fuel choice for achieving fusion is a combination of two isotopes of hydrogen—deuterium and tritium. But Helion has swapped in helium-3 for the latter.

That would produce fewer neutrons, a subatomic particle usually nestled in the nuclei that makes other objects radioactive, which should thus reduce damage to the device and ease downstream radioactive waste issues. But it also complicates the process for obtaining the necessary fuels and the engineering required to bring about fusion conditions, Wilson says.

Similarly, the pulsed approach, which rival startups like Zap Energy are also pursuing versions of, does eliminate the need to create sustained fusion reactions. But it also makes the up-front engineering a lot trickier.

“The challenge is to prove … whether they can create a large enough pulse to create enough energy, and then capture enough of it to fuel the next pulse,” Wilson says. “If they are able to do so, then the engineering challenges they may face for the rest of the system would be easier than what some of the other companies are trying to accomplish.”

“Super confident”There are a few additional points in Helion’s favor, including the fact that the company has a significant war chest to fund its efforts.

Helion has raised $570 million in venture capital to date, from investors such as Peter Thiel’s Mithril Capital, Y Combinator, Facebook cofounder Dustin Moskovitz, and LinkedIn cofounder Reid Hoffman. But the bulk of its funds came from a $500 million round announced in November 2021 that included $375 million from Sam Altman, the CEO of OpenAI—his largest single investment.

Altman previously told MIT Technology Review that he initially put about $10 million into Helion but dramatically boosted his investment as he “became super confident it is going to work.”

Helion’s seventh-generation prototype fusion generator, Polaris.

Helion’s seventh-generation prototype fusion generator, Polaris.

Under the deal announced on Wednesday, Microsoft will pay for electricity that Helion generates, assuming the plant is eventually built and operated. The software company didn’t respond to questions about whether there was any up-front money involved, or whether it has made any investments in Helion.

The agreement allows Helion to zero in on a location and demonstrates a market demand that could spur additional activity in commercial fusion, Kirtley says.

Brad Smith, vice chair and president at Microsoft, said in a prepared statement that the deal will support the software company’s “long-term clean energy goals” and “will advance the market to establish a new, efficient method for bringing more clean energy to the grid, faster.”

Regulatory challengesAmid the increasing commercial activity, the US Nuclear Regulatory Commission recently made a key determination over how it will license fusion plants, adopting an approach used for research particle accelerators rather than the more onerous process used for fission power plants.

Fusion systems do produce nuclear waste, which necessitates careful procedures and rules for handling the materials and eventually decommissioning the plants, experts say. But the facilities don’t generate the same very long-lasting radioactive refuse that fission plants do, or present the same sorts of storage challenges, controversies, and weapons proliferation risks that go with it.

The NRC staff now will need to develop a specific “rule-making” process for licensing fusion within that approach, which could still take months to years.

But going forward, it appears that fusion projects should be approved faster than traditional nuclear plants, which can easily take a decade to license and build in the US, Stein of the Breakthrough Institute says.

For his part, Kirtley is “confident” that Helion will be able to turn on the world’s first fusion power plant in 2028, given the progress it’s made, the NRC decision, their ongoing work with state and federal regulators, and the fact that they’ve already licensed a handful of prototypes.

But he does acknowledge that the company faces big challenges and some potential for delays.

“The truth is fusion is hard, and new power plants are hard, and first-of-a-kind anythings are also hard,” he says. “It’s one reason we’re trying to get out in front and trying to solve all those problems today.”