Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

DEV FOR 2025 / 2026

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

DEV FOR 2025 / 2026

About Me

Latinos Media

Latinos Media Latinos Media provides all types of news feeds on a daily basis to our Members

Posted by - Latinos Media -

on - March 24, 2023 -

Filed in - Financial -

-

4.5K Views - 0 Comments - 0 Likes - 0 Reviews

If you’re looking to launch your startup, or are in the early stages of establishing your business, then you may have a long-term vision for huge growth. And that type of growth needs investment.

Despite all the overwhelming challenges of our economy, cost of living crisis and access to capital, the dream of one day having a business that’s a household name will have definitely crossed your mind. But how exactly do you do it?

The answer lies in what all the big companies do at some point to grow. It's what we are talking about in this article today, and it is known as Series A, B and C funding.

In this guide, we’ll explain the key differences between each of these funding rounds, and the stages of growth your business will need to have reached in order to attract such investment. Plus, we’ll arm you with the info you need to understand the business benefits – and risks – that come into play at each stage.

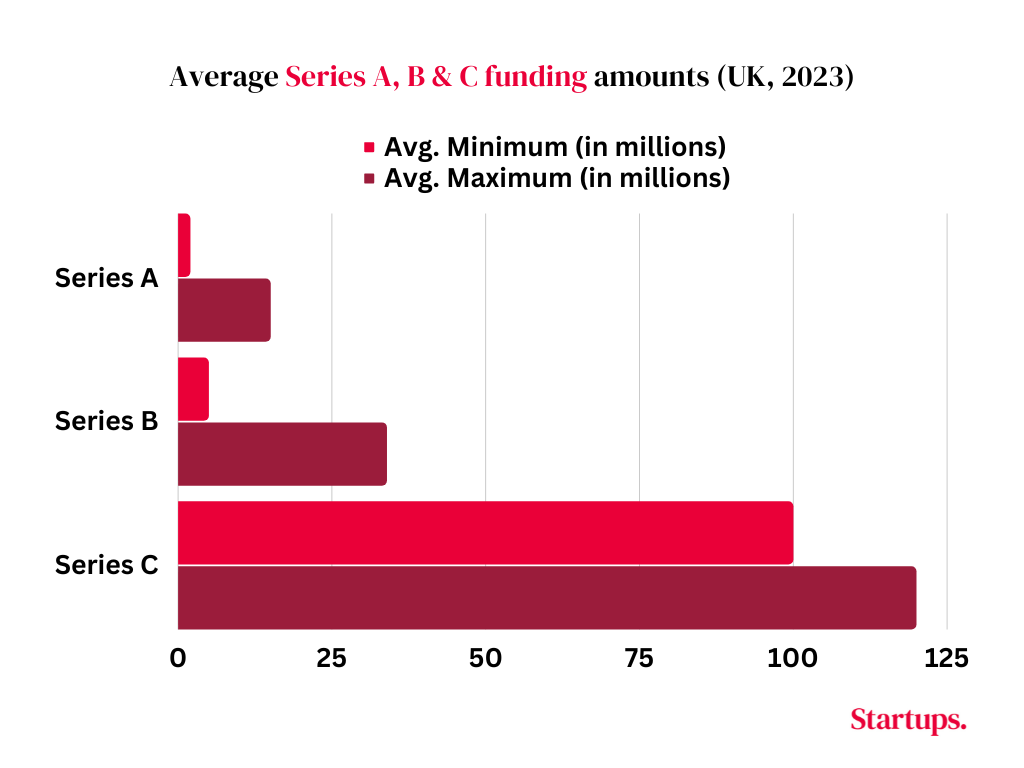

Series A: £2 – 18 million (Source/Source)

Series B: £5 – 33.9 million (Source/Source)

Series C: £100 – 120 million (Source)

Starting at the beginning: to grow, you will need to aim to secure venture capital.

This is where funding in all its different forms comes into play. Once you have secured your investors, the traditional way funding rounds work is to provide you with a specific amount of funding (and potentially also support) relative to the stage of business you’re in.

It increases incrementally as your business grows, following the pattern of the alphabet as and when investors or company founders feel that more funding is needed.

How does Series round funding differ from pre-seed and seed funding?Series A, B and C funding is available only to startups that are somewhat already established. They usually have to be already seen as “up and coming” and already growing steadily or rapidly.

For any businesses that are not at this stage yet, there are a couple of phases before series A, B or C begin. These are pre-seed and seed funding stages – however, they are rare to obtain.

It is much harder to get funding for a business that hasn’t started yet, or is still only at the business idea or business plan stage. But, it’s not impossible.

In such cases, if a venture capital firm or angel investor decides that they really love and believe in your idea, you may receive what is known as pre-seed or seed funding before your seed funding stage begins.

Series A funding refers to the first official round of financing by venture capitalists or other investors, excluding any pre-seed or seed rounds, which are rare and not a given for every business as mentioned above.

When does Series A funding happen?During Series A funding, investors are typically looking for a market-proven product that will allow you to easily multiply in revenue within 18 months.

How does Series A differ from other forms of investment?Series A is a crucial growth development stage and round of funding where investors (particularly early-stage investors) may be attracted by the potential of your company.

This is an excellent time to capitalise on that hype and to make a great impression with ROI. Play this stage right, and can set you up really nicely for the next rounds.

How much equity do investors take at Series A?Small business owners should expect to give away around 20-25% of their company equity at this stage, as this is the industry standard.

What are the benefits and drawbacks of Series A Funding?At this stage, Series A funding is particularly useful in building the foundations of the business that will help propel the company forward and hopefully have it start out on strong terms right out of the gate.

Building foundations involves things like:

While some people do receive financial help from friends and family members when they are just starting out with their businesses, it is usually not enough to cover all of these things in the same way Series A can.

One of the main drawbacks of course (and this will be prevalent in all types of funding), is the loss of complete control. When you accept series A funding, investors become stakeholders in your company. With that will come a whole new wave of responsibility, management duties and differing opinions on what your company should do next. All of that will need to be regulated and mitigated which can quickly become overwhelming if not done right.

Is it hard to get Series A funding?It is not hard to get Series A funding, as long as the conditions above are met – i.e, the company needs to already have been market proven for you to receive this kind of funding.

Investments at Series A stage are still considered risky. But, with significant capital and a working product, investors can still expect strong capital growth if the business does well.

Investors will also be more likely to back a business at this stage if the entrepreneur in question has already had a successful large exit with a previous startup, or already has significant experience and connections within their industry.

Series B funding refers to the second official round of financing by venture capitalists or other investors.

When does Series B funding happen?Series B typically happens 3-18 months after Series A.

How much equity do investors take at Series B?Small business owners should expect to give away around 10-20% of their company equity (averaging 15%) at this stage.

How does Series B differ from other forms of investment?At this stage, investors would have expected you to be fully out of the newbie, growth stages of business. You should have your foundations well established and in place, and the aim of this next round is for expansion.

This could involve significant expansion of headcount, penetration of new markets and customers, or with new products. All of this is with the intention of keeping the business fresh in the eyes of other investors and the consumer market.

Such expansion shows commitment from the company founders that proves they aim to keep the business running for the longer term and shows that they have an eye on the pulse, and can anticipate changes and trends that may prevent the business from going under. All of these are qualities investors love to see.

What are the benefits and drawbacks of Series B Funding?With most companies failing within five years due, Series B funding can often prove to be a turning point in determining whether or not a business can truly stand the test of time.

It provides bridge financing which carries the business over from a stage of requiring financial support to survive, to being able to survive fully on its own via profits, having established solid footing in the industry.

Where Series C and beyond are harder to get, and more of a pipe dream for 80% of companies, Series B is a solid accomplishment and one that most well-known and successful businesses you can think of are currently operating at today.

A potential drawback when it comes to Series B is that it can potentially become easy to get complacent at this stage. Your financial needs have been satiated by the influx of investment, and business is running smoothly at this stage – which for some people, despite the ever-present stakeholder pressure, may find it easy to start coasting a little here. Not underwhelming supporters and investors, but not exactly thrilling them either.

Is it hard to get Series B funding?Series B funding is undeniably harder to receive than Series A funding, as there is a lot more to prove at this stage.

You’ll have to show significant, measurable growth from your previous round of funding, as well as what you did with the money and how it positively impacted your business. You’ll need a coherent and credible business plan laying out your next steps and how you intend to possibly 2x, 3x or 5x the growth with the money from this round.

You are unlikely to receive Series B funding if growth to date has been minimal; if your Series A funding was used ineffectively; or, if you are experiencing a downturn in sales and profit.

Series C funding refers to the third (and usually ‘final’) official round of financing by venture capitalists or other investors.

When does Series C funding happen?Series C can happen within a year of Series B, but is much more likely to happen two years after.

How much equity do investors take at Series C?Small business owners should expect to give away around 10-20% of their company equity at this stage, similar to Series B.

How does Series C differ from other forms of investment?At this stage, investors expect you to be batting in the big leagues.

This means you’re demonstrating rapid scaling of your employees, your customers, and your systems – investors will want to see it all. With the potential to reach an initial public offering (IPO) in sight at this stage, it’s all hands on deck. This is a round where investors will have many more opinions and may actually want to become more hands-on than ever before. This is a stage not many companies reach, so, if you have, it signals exponential success for everyone.

To achieve this kind of scaling, investors may be expecting you to do things such as buying other companies or other technologies to achieve that immediate uptick of people and resources needed for your large-scale operations. It might also mean launching new verticals, new product ranges and demonstrating optimisation of your traditional model.

What are the benefits and drawbacks of Series C Funding?The biggest benefit of reaching Series C is that your company will have a lot of eyes on it!

You won’t be at a loss for attention, whether that’s options for financing, or attention from the public and the media. Your company will be considered a household name, an innovator or industry standard, and the one to watch.

This popularity, however, can also become a potential drawback in equal measure.

This round is fast-paced, and there will be a lot of feedback and opinions flying about. The downside can be leaving a founder or senior team drawn into a hundred different directions – and it will all be down to the leadership to keep a level head, keep the stakeholders happy and the team on track.

A business courting Series C funding will be blooming already. Investors (particularly late-stage investors) may also be aggressively pursuing you to claim more equity. Now that the company is considered practically fool-proof, this is what investors see as the ‘last official stage’ to invest at a good price to still gain a good return in future before it becomes too saturated or overly expensive after entering the public market.

You may even have to be careful to ensure that you maintain the lion’s share of your business, to avoid investors having too much power and using it to potentially oust you from your own company.

If not wholly prepared, business owners and founders may find the new pace hard to keep up with and this may damage the trajectory of the business at the very last hurdle.

Is it hard to get Series C funding?It is very hard to get Series C funding.

Few companies reach Series B funding, and fewer still reach the Series C stage, unable to progress at a safe and steady Series B-style pace. Even without failing, a business may not be particularly innovating, or exponentially growing at legendary levels.

Startups that are at the Series C stage of funding have all but proven to venture capital firms that they’ll be a long-term success – with original backer’s shares now having increased considerably in value.

Once you go beyond Series C, it typically means that the business has garnered a significant amount of money and success, and investors can now enjoy this to the fullest by holding or selling their shares as the business reaches the public equity market through an initial public offering (IPO).

According to PitchBook, only 3% of venture-backed companies in the last decade made it to public.

With the average security requirements for a startup to go public averaging at £100 million, most startups never reach the option to do so.

It still remains the ultimate end goal or dream for most company owners, however.

So there you have it: by now you should have a clear understanding of the funding rounds most companies aim to traverse through on their journey from small to big time.

For a startup founder taking their very first steps, these funding rounds may feel intangibly distant. But, with a clear-sighted view of the expectations of each stage, you should feel better armed for planning a growth journey that could hopefully see you join the big leagues.