Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

About Me

Latinos Media

Latinos Media Latinos Media provides all types of news feeds on a daily basis to our Members

Posted by - Latinos Media -

on - March 30, 2023 -

Filed in - Financial -

-

590 Views - 0 Comments - 0 Likes - 0 Reviews

Back in February, Northspyre announced it had raised $25 million to bring costs under control for big building projects. (TechCrunch’s Mary Ann Azevedo mentioned the fundraise in her fintech newsletter.)

It’s a huge industry with powerful potential — so how does a company like that tell the story of what it’s building? We’re lucky enough to be able to share Northspyre’s pitch deck with you today. Get the crowbar; let’s break this thing open to see what’s inside.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deckThe company tells me it removed a few of the most financially sensitive slides from the deck before sharing it with us; what is left behind is a spectacularly well-designed, clean and clear deck.

Northspyre has a mature and well-designed deck that is a sight for sore eyes compared to many of the others we’ve looked at as part of this series. Here are a few highlights.

Gotta love this mic drop of a market slideFor some markets, you have to go in-depth to explain why this is a market worth going after. That’s particularly true for technology companies that are working in emerging industries. Construction ain’t one of those, and so you kind of get away with anything. Including:

[Slide 5] Market size? Huge. Next question. Image Credits: Northspyre

As a startup, it’s a good idea to read the assignment before filling out the answer; if you label your slide “product,” it had best touch on at least some of the things that investors are looking for in a product slide.

However … the one thing to be careful of here: When you’re talking about market sizes, you’re not usually talking about the size of the full value of goods sold. If you are eBay, your market size isn’t the list price of all of the sneakers, video games and cars listed on the site; it’s the buyer’s fees and sales commissions of the same. In other words: The market size for eBay for the sale of a single PlayStation 5 is probably around $30 or so not $500.

Northspyre is getting dangerously close to making that mistake here: Even if the company executes with utter perfection, it isn’t going to become a $2 trillion company. To be fair, they aren’t necessarily claiming that here — and it’s probably irrelevant, given that the market is intuitively huge — but for a perfect score here, the startup could have figured out what its real TAM/SAM/SOM numbers are and have an intelligent conversation about that.

Be very careful about what it is you’re actually promising as your market size. By all means: Report the top-line number for the entire market, but you have to drill down from there to get the full picture.

Answers the “why” beautifully

[Slide 7] What’s the value you deliver to your customers? Image Credits: Northspyre

A fair few startups are unable to tell the “but why should I care as an investor?” story, and it’s a relief to see Northspyre avoid that trap. This is a solid value proposition and a great idea to highlight to your investors.

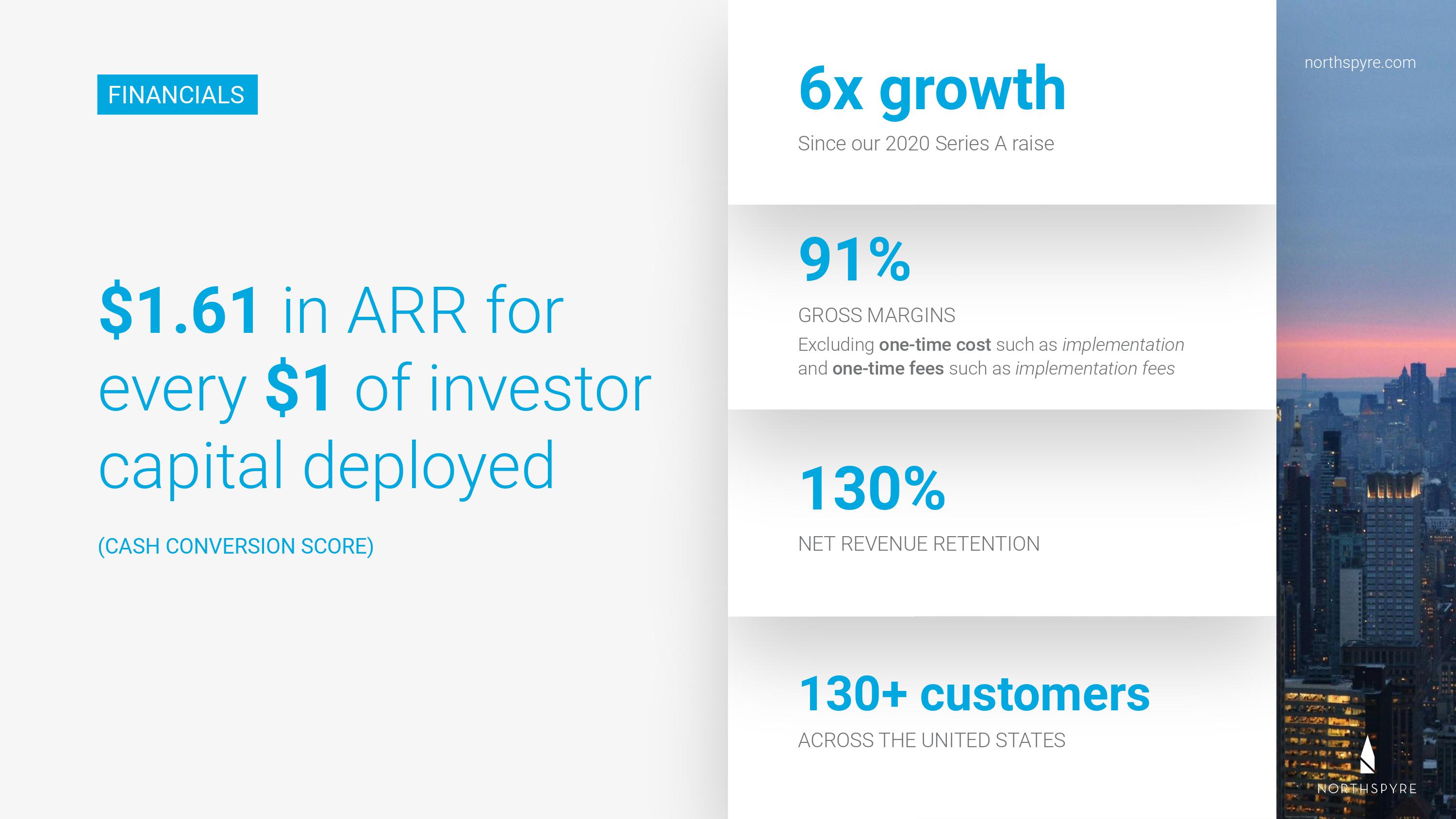

KPIsThe company has this slide listed as its “financials” slide. It isn’t; financials are usually presented either as an operating plan or as “proper” financials showing more in-depth spreadsheets or overviews of what the next three to five years of a company look like. This slide is mislabeled, but that doesn’t mean it doesn’t tell a helpful part of the story:

[Slide 8] Financials they ain’t, but helpful they are. Image Credits: Northspyre

Gross margins of 91% are SaaS-level returns, and 130% net revenue retention is beyond impressive. It means that, on average, customers increase their spend with Northspyre instead of churning away. A customer count of 130 is less impressive — presumably, some of those aren’t the most important customers — but it shows that the company at least has a pipeline for acquiring customers that is scalable up to a point. Those are all positive.

The other great thing is that it shows that Northspyre knows what the important KPIs are: gross margin, NRR, growth and number of customers are all worth tracking.

The $1.61 of ARR for every $1 invested is a little fuzzier, and I’m less sure why this particular number is on this slide. If this is a historical number, I’d be eager to understand how confident the company is that it can continue along this trajectory. How sure is it that if it raises $20 million, it will have an additional $32.2 million added to its ARR figure by the end of the 12-month period? If that confidence is low (or comes with caveats), it means the company is peddling numbers that are a little on the vanity side of things.

Now, I’m not going to give Northspyre a hard time here. It has additional slides on financials that are removed from this deck, so it’s possible there’s other helpful data elsewhere.

But as a startup, what you can learn from this example is to ensure that you signal to your investors that you know what the most important metrics are within your business. Pair that with a “go to market” or “growth” slide to draw the historical lines into the future, and you’ve gone a long way toward highlighting why you’re worth the investment.

In the rest of this teardown, we’ll take a look at three things Northspyre could have improved or done differently — including how its product slide isn’t, in fact, a product slide — along with its full pitch deck!

Pitch Deck Teardown: Northspyre’s $25 million Series B deck by Haje Jan Kamps originally published on TechCrunch