Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

About Me

Latinos Media

Latinos Media Latinos Media provides all types of news feeds on a daily basis to our Members

Posted by - Latinos Media -

on - March 23, 2023 -

Filed in - Financial -

-

533 Views - 0 Comments - 0 Likes - 0 Reviews

Sainsbury’s (LSE:SBRY) is one of the FTSE 100‘s most popular shares. This is because it’s one of the few UK supermarket stocks available to trade on the public market. With that in mind, how much better off would I be had I bought the stock earlier this year?

A whole basket of returnsIf I’d invested £1,000 just under three months ago, the retail stock would’ve generated a return of approximately 17% on my investment. This translates to roughly a profit of £117, excluding broker fees and/or capital gains tax.

| Metrics | Sainsbury’s shares |

|---|---|

| Amount invested | £1,000 |

| Stock growth | 17% |

| Total dividends | N/A |

| Total return | £1,170 |

Given the time frame and wider performance of the stock market, Sainsbury’s shares have actually generated a rather large return. The FTSE 100 is flat, while the S&P 500 is only up 3% since January. Nonetheless, there are several reasons for the shares’ recent rally.

The first being that undervalued stocks got lots of attention at the start of the year as UK shares were recovering from the events of the mini budget in October. Sainsbury’s share price then got a further boost when Bestway bought a huge stake worth £250m in the company.

Investors are hoping that Bestway’s position could benefit JS given the former’s expertise in cutting costs. And with a strong Christmas update as well, sentiment continued to stay positive for the orange-labelled supermarket.

| Metrics | Q3 2023 | Q3 2022 |

|---|---|---|

| Grocery | 5.6% | 12.5% |

| General merchandise | 4.6% | -6.9% |

| Like-for-like sales (ex. fuel) | 5.9% | -4.5% |

| Like-for-like sales (inc. fuel) | 6.8% | 0.6% |

Having said that, Sainsbury’s shares may find it difficult to make such big gains moving forward — at least in the short term. The stock has been trading sideways since late January. Investors are cautious that the grocer may not be able to meet its improved outlook given the continued uptick in food inflation.

| Metrics | FY23 outlook |

|---|---|

| Profit before tax (PBT) | £630m to £690m |

| Free cash flow | £600m |

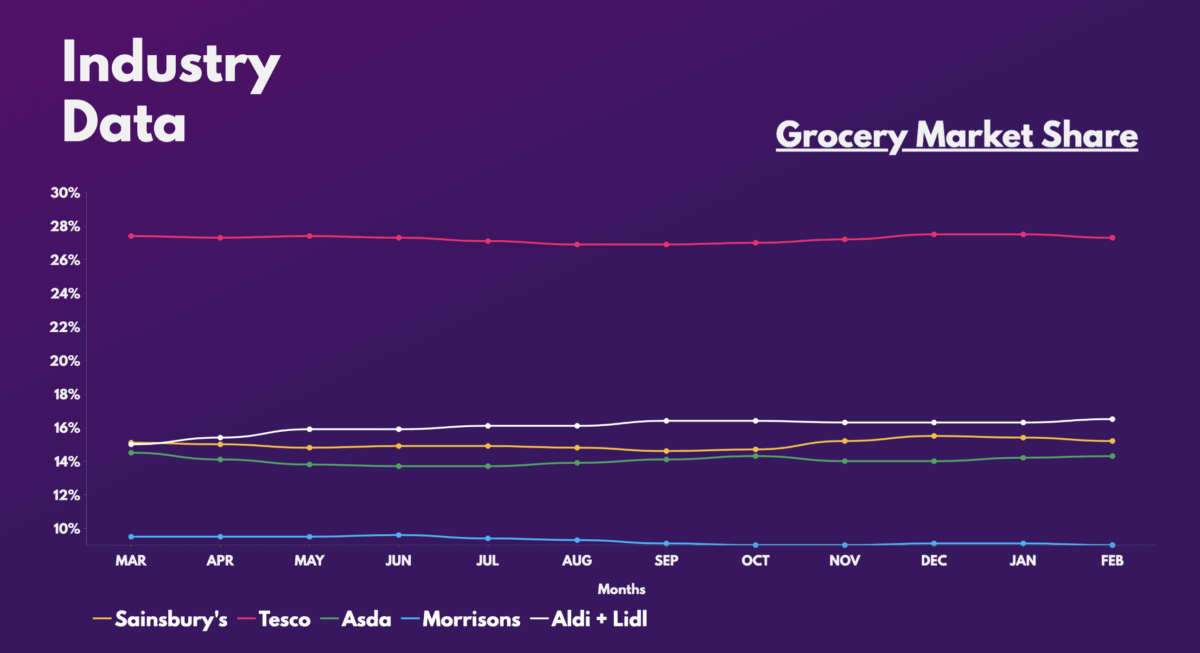

The shakiness surrounding the company’s market share isn’t entirely convincing either. This could indicate that customers are fleeing to discounters Aldi and Lidl, consequently depressing sales at Sainsbury’s.

Data source: KantarAre Sainsbury’s shares worth buying?

Data source: KantarAre Sainsbury’s shares worth buying?

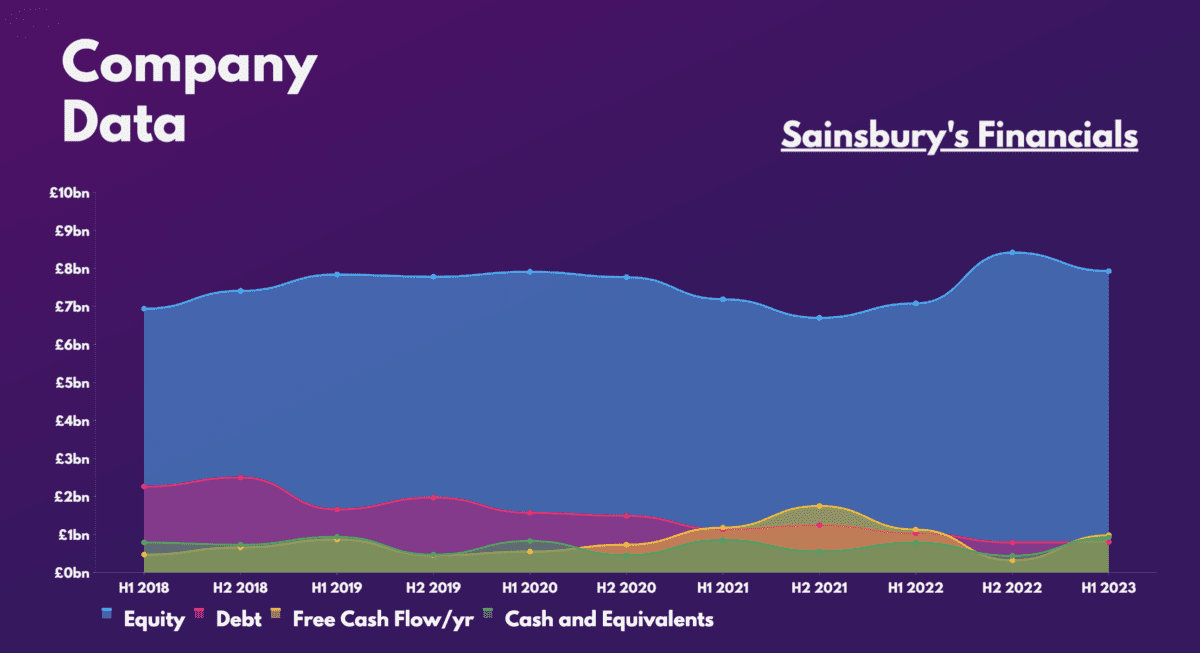

Putting that side, it must be said that the conglomerate has a stellar balance sheet, especially when compared to Tesco. Pair that with a healthy dividend yield of 4.1% and there’s an argument to be made that Sainsbury’s stock may be a better investment than its bigger counterpart.

Data source: Sainsbury’s

Data source: Sainsbury’s

What’s more, it has got attractive valuation multiples — all of which are below the industry average, even after this year’s strong performance so far. That said, the stock has an average price target of £2.48. And with Sainsbury’s share price currently at £2.63, this puts it 6% above its target price.

| Metrics | Sainsbury’s | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.8 | 1.4 |

| Price-to-sales (P/S) ratio | 0.2 | 0.3 |

| Price-to-earnings (P/E) ratio | 10.5 | 13.4 |

| Forward price-to-sales (FP/S) ratio | 0.2 | 0.4 |

| Forward price-to-earnings (FP/E) ratio | 13.7 | 12.4 |

This could mean that there’s more chance of the stock declining than rising further. Therefore, it’s no surprise to see that brokers from Jefferies and JP Morgan remain ‘underweight’ on the stock.

The group could very well see further share-price gains in the medium term through better and more efficient cost savings, especially now that Bestway is on board. Additionally, the retailer’s Argos division could expand successfully and bring a strong and growing revenue stream while expanding margins.

However, I don’t see this happening any time soon. There doesn’t seem to be catalysts pointing towards a meaningful growth in market share nor earnings. As such, if I’d bought Sainsbury’s shares at the start of the year, I would be looking to sell them for a profit given the limited growth potential, and reinvest in a different British stock to buy and hold for the long term.

The post If I’d invested £1,000 in Sainsbury’s shares at the start of 2023, here’s what I’d have now appeared first on The Motley Fool UK.

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

setButtonColorDefaults("#5FA85D", 'background', '#5FA85D'); setButtonColorDefaults("#43A24A", 'border-color', '#43A24A'); setButtonColorDefaults("#FFFFFF", 'color', '#FFFFFF'); })()

More reading

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. John Choong has no position in any of the shares mentioned. The Motley Fool UK has recommended J Sainsbury Plc and Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.