Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

About Me

Latinos Media

Latinos Media Latinos Media provides all types of news feeds on a daily basis to our Members

Posted by - Latinos Media -

on - June 11, 2023 -

Filed in - Financial -

-

666 Views - 0 Comments - 0 Likes - 0 Reviews

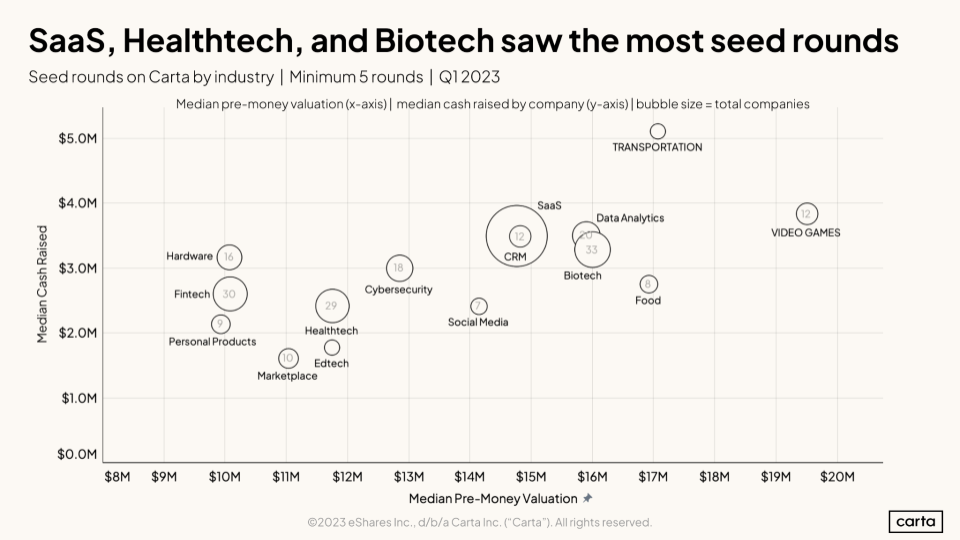

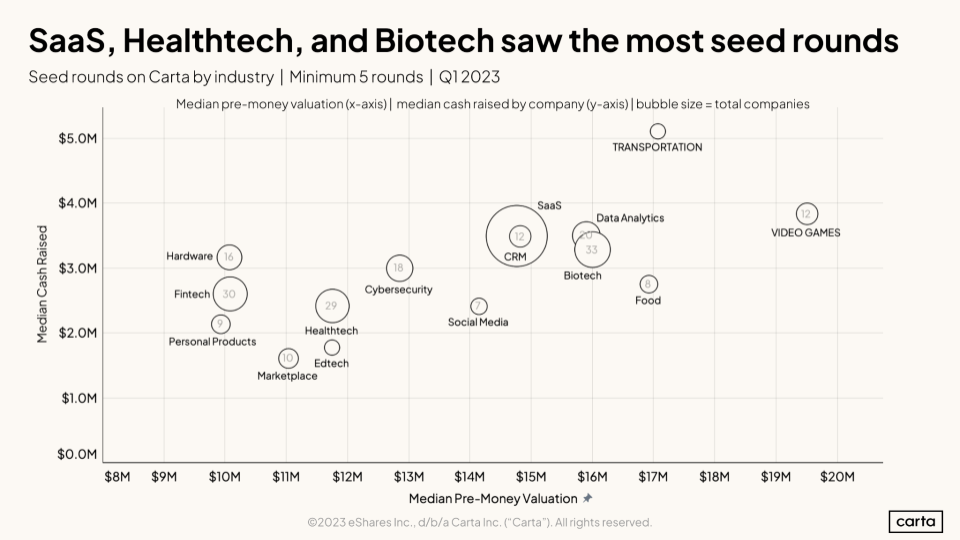

If you want to score the largest possible early-stage valuation, what should your startup focus on? New data makes it clear that the seed and Series A markets are hardly equal when it comes to what venture capitalists are willing to pay for one category of startup over another.

Don’t worry, the answer here is not just “build an AI startup,” even if that does appear to be pretty solid advice for avoiding a down round.

Data shared by Carta when we interviewed the company’s CEO on the Equity podcast earlier this week provides a simple and clear stratification of early-stage valuations and fundraising sizing. Let’s start with seed data:

Image Credits: Carta

Here are the most richly valued startup types in today’s early-stage venture market by Alex Wilhelm originally published on TechCrunch