Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

About Me

Latinos Media

Latinos Media Latinos Media provides all types of news feeds on a daily basis to our Members

Posted by - Latinos Media -

on - December 2, 2023 -

Filed in - Technology -

-

598 Views - 0 Comments - 0 Likes - 0 Reviews

Lost in a stupor of déjà vu, I rang the intercom buzzer a second time. I had the odd sensation of being unstuck in time. The headquarters of this solar startup looked strangely similar to its previous offices, which I had visited more than a decade before. The name of the company had changed from 1366 Technologies to CubicPV, and it had moved about a mile away. But the rest felt familiar, right down to what I had come to talk about: a climate-tech boom.

A surge in cleantech investments, which had begun in 2006 with the high-profile entry of some of Silicon Valley’s leading venture capitalists, was still going strong during my first visit, in 2010—or at least it seemed to be. But a year later, it had begun to collapse. The rise of fracking was making natural gas cheap and abundant. US government funding for clean-energy research and deployment was falling. Meanwhile, China had begun to dominate solar and battery manufacturing. By the end of 2011, almost all the renewable-energy startups in the US were dead or struggling to survive.

The list of eventual casualties included headline grabbers like the solar-cell maker Solyndra and the high-flying battery company A123, as well as numerous less well-known startups in areas like advanced biofuels, innovative battery tech, and solar power. How, I was wondering, had CubicPV survived when nearly all its peers had failed?

Ushering me into the conference room (was that the same photo of a solar panel hanging on the wall that I had seen a decade before?), Frank van Mierlo, who is still the CEO, seemed almost giddy. And why not? After more than 10 years in photovoltaic limbo, with few opportunities to scale up its process for making the silicon wafers used in solar cells, the venture-backed company had suddenly seen its fortunes turn around.

The excitement around cleantech investments and manufacturing is back, and the money is flowing again. The 2022 US Inflation Reduction Act, which provides strong incentives for US domestic solar manufacturing, changed everything, says van Mierlo. As of this summer, some 44 new US plants had been planned, providing CubicPV with a huge potential demand for its silicon wafers.

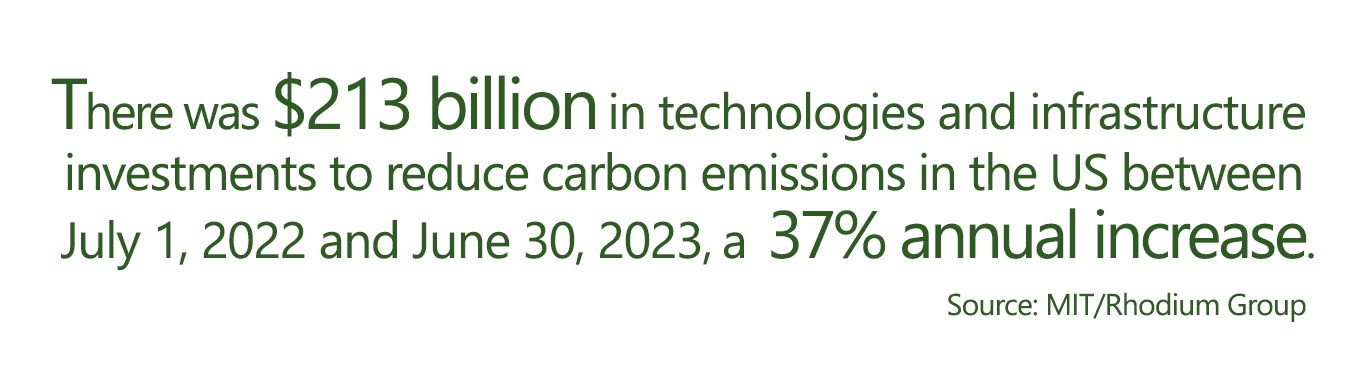

Call it cleantech 2.0. In recent years, there has been a huge increase in public and private spending, both in the US and elsewhere, on technologies and infrastructure to address climate change. A recent analysis estimates that total green investments reached $213 billion in the US during the 12 months beginning July, 2022. Most of that spending is allocated to building sources of renewable energy, such as wind or solar, as well as to supporting battery and EV manufacturing and creating green hydrogen infrastructure. And the enormous amount of money is creating potential opportunities for the next generation of technologies to feed the expanding markets.

For startups like CubicPV, this means that after years of little market demand, the appetite for its products is suddenly almost insatiable. The company is designing a billion-dollar plant to make the silicon wafers needed to feed the rapid expansion in US solar production. What’s more, a bigger solar manufacturing base could eventually provide the startup with a lucrative future market for its next innovation: a new type of solar panel that is far more efficient at capturing sunlight than conventional silicon ones.

Silicon Valley and venture capitalists everywhere have fallen in love with the virtues and the promise of new catalysts and electrodes. Innovations in solar cells no longer seem like a lost cause. Startups are boasting radical new technologies for energy storage and carbon-free processes for making chemicals, steel, and cement. Investors are risking billions on scaling up nascent technologies such as geothermal power, fusion reactors, and ways to capture carbon dioxide directly from the air.

These innovations in what is being called “deep” or “hard” tech—products and processes based on science and engineering advances—could be critical in addressing climate change. While the past few years have seen remarkable progress in deploying relatively mature renewables such as solar and wind power, as well as strong growth in electric-vehicle sales, large gaps in the cleantech portfolio remain. In its most recent report this fall, the International Energy Agency estimates that around 35% of the emissions cuts needed to meet 2050 climate goals will have to come from technologies not yet available.

Key industrial sectors of the economy, in particular, have largely been untouched. Nearly a third of carbon emissions come from industrial processes used to make steel, cement, chemicals, and other commodities; concrete alone accounts for more than 7% of global emissions, while steel production is responsible for another 7% to 9%. Cleaning up these industries will take an almost unlimited supply of cheap, steady, and easily accessible carbon-free energy.

Progress will almost certainly require new science-based innovations. And that’s where venture-backed startups play an essential role. Over the last few decades, large industrial corporations in sectors such as energy, chemicals, and materials have all but abandoned research into new technologies. The days when industrial giants like DuPont created critical new technologies and spun them off into profitable operations are long gone. And while governments and universities fund research, venture-backed firms have emerged as an increasingly key outlet for transforming promising lab discoveries into sustainable businesses.

A slew of such startups are now rapidly moving toward commercialization, providing the first steps toward industrial decarbonization and adoption of radically new energy sources (see chart). But these startups still face some of the same issues that tripped up the cleantech revolution a decade ago.

Transforming academic advances in physical sciences and engineering into commercial businesses is a project that’s fraught with dangers. It typically requires startups to build so-called demonstration plants at a relatively large scale to test whether their processes work beyond the lab and are efficient enough to compete with existing technologies. This is risky and expensive. Then, if it all works, startups commercializing, say, new energy sources or low-carbon processes to make concrete or steel face low-margin, well-established markets. They must often compete with mature processes that have been optimized over many decades.

These costly and time-consuming steps to commercialization, which a climate-tech startup must survive before it has any significant revenues, is often known as the “valley of death.” Few startups in cleantech 1.0 were able to navigate it.

The question now is: Can today’s ambitious startups successfully scale up their technologies and move across that valley this time around? These fledging venture-backed companies will first need to prove that their technologies work at a commercial scale. Then, if successful, they face the even harder challenge of making an impact on the huge energy and industrial markets, figuring out how to work with established companies to clean up these sectors. Can they survive?

Born againThe bad news is that the record for such venture-backed startups is dismal. From 2006 to around 2011, when much of the sector lay in ashes, venture capitalists spent about $25 billion on cleantech startups. The VCs lost more than half their money. It was particularly bad for those firms we would now call deep-tech startups; investments in stuff like new types of solar cells, advanced biofuels, and novel battery chemistries returned only about 16 cents on a dollar.

For much of the rest of the decade, investors hunkered down. As spending on cleantech dwindled to miserly levels, consumer-facing software-based businesses (think Airbnb and Uber) took off. The common wisdom was that advances based on science and engineering in cleantech were too expensive and risky to scale up. The proportion of venture capital going to cleantech dropped from more than 8% in 2008 to around 3% between 2016 and 2020.

Even before the 2022 IRA passed, however, venture investors had again begun eyeing the massive potential markets for climate tech, as governments around the world increased spending and more and more corporations set long-term emission-reduction goals. The markets are now real and growing, not speculative. While innovative battery startups a decade ago faced a tiny market for electric vehicles, today there is a huge demand for cheaper and more powerful batteries as sales of EVs take off. Likewise, demand for grid storage is growing as more renewable power is deployed and for cleaner industrial processes as companies pledge to reduce their carbon pollution.

Yet the trajectory of climate tech in recent years hasn’t been a straight line. Venture investments in cleantech startups, which amounted to just $2 billion in 2013, soared to nearly $30 billion in the US by 2021, according to the National Venture Capital Association. Then, just as things started to heat up, inflation and the resulting rise in interest rates began to make borrowing money expensive. The general venture capital market began to crash in 2022, and investments in climate tech soon followed. In the first half of 2023, investments in climate-tech startups were down 40% from the same period in 2022, reports Sightline Climate, a market intelligence firm.

But dig deeper into the numbers and a mixed picture emerges. For one thing, Sightline Climate says investments have begun creeping back up in the latest quarter this fall. And though funding overall became more difficult to secure in the first half of 2023, some companies—especially in markets favored by the IRA legislation, like green hydrogen, batteries, solar, and carbon capture from the air—are still raising large amounts of money. According to the latest data from the Engine, a “tough tech” venture group spun out of MIT, VC investments in startups working on industrial chemicals, materials, and carbon capture were actually up in the first half of 2023 from the same period in 2022—in fact, they were nearly at 2021 levels.

For some startups, however, readily available cash has dried up, providing a reality check on their sustainability. And the first few failures could raise the ghosts of cleantech 1.0. But for many others, the financial downturn is simply the most recent reminder that climate-tech investments aren’t exempt from swings in the health of the economy.

The same fundamental challenge that venture-backed startups faced in commercializing transformative technologies 15 years ago still exist. Novel, gee-whiz tech is not enough; a clear plan to target well-defined markets remains key to survival. “What is the path to market for these technologies?” asks David Popp, an economist at Syracuse University. He attributes the collapse of startups in cleantech 1.0 largely to the lack of demand for green products in highly competitive commodity markets. And that business puzzle, he says, remains: “I’m kind of curious to see, looking back five years from now, whether we’ll be looking at this like the first cleantech bubble.”

New money. Old problems.In an influential 2016 post-mortem of cleantech 1.0 by the MIT Energy Initiative, several researchers analyzed what went wrong and concluded that venture capital was “the wrong model for clean energy innovation,” putting the blame on VCs’ unsuccessful attempts to fund startups through the “valley of death” by themselves. Simply put, the VCs quickly ran out of money and patience. The report’s conclusion: “The sector requires a more diverse set of actors and innovation models.”

The good news is that the types of investors funding cleantech have in fact become more diversified. Arguably the biggest difference is that VCs are no longer going it alone. Thanks to the huge potential markets in renewable power and industrial decarbonization, there is a growing appetite among other types of investors to fund expensive and risky scale-up projects.

Many of these investing groups, which includes hedge funds, corporations, growth investors, and even wealthy individuals, can readily write checks for $100 million or $200 million, and today they’re providing much of the funding for the flurry of demonstration plants. “There is a whole new generation of investors whose entire business is financing first deployment to nth deployment,” says Matthew Nordan, general partner at Azolla Ventures. “That didn’t exist before, and that is where many of the [earlier] companies died on the shoals.”

The new investors include companies in sectors such as steel, chemicals, and concrete that are bracing for an inevitable long-term shift to lower-carbon processes. Typically led by their venture groups, these corporations—such as steel manufacturer ArcelorMittal and Siam Cement Group, a conglomerate based in Bangkok—are supporting startups in their areas of business with financing and engineering expertise. And though their commitment to investing in climate-tech startups is sometimes viewed with skepticism, the money is real—and so is the time and expertise they’re bringing to the new technologies.

Still, Francis O’Sullivan, one of the authors of the 2016 MIT report who is now a lead climate investor at S2G Ventures, says that the way the startups are funded remains broken. The problem now, O’Sullivan says, is that the money is in several different types of buckets. There is a huge amount of money going to early-stage startups. And there is also ample money from banks and institutional investors for so-called infrastructure spending on well-proven technology (such as building a new wind or solar farm). But the bucket of money for the critical “growth stage”—funding for the demonstration of first-of-a-kind technologies—is relatively small.

In a report just completed, O’Sullivan and Gokul Raghavan, his colleague at S2G Ventures, calculated that between 2017 and 2022, US and European private investors raised $270 billion for what the authors broadly define as the energy transition. Some $120 billion went to early-stage, venture-backed companies, and another $100 billion was for later infrastructure spending. Only about $50 billion went to so-called growth-stage funding.

What is getting shortchanged, says O’Sullivan, is financing for the scale-up of risky new technologies—the stage where startups find out if their innovative technologies actually work and are economical. It means many highly valued early-stage climate-tech startups could be stranded without an apparent path forward. It’s “one of the most significant barriers” to industrial decarbonization, says O’Sullivan.

Moving beyond greenwashingBeyond financing, there are other fundamental obstacles in the path toward industrial decarbonization. Chief among them: startups need to understand the challenges of large manufacturing processes. Many venture investors in cleantech 1.0 were from internet businesses and “applied software heuristics to things clearly not software companies,” says Ramana Nanda, a finance professor at Imperial College London and founder of its Institute for Deep Tech Entrepreneurship.

“I think the big lesson from cleantech 1.0,” he says, “is that molecules don’t work the same way as bytes.” For one thing, he says, “we really don’t know if something will work until we build that large demonstration plant that costs lots of money.”

And even if the new technology works, Nanda points out, startups are often facing risk-averse industrial customers that have invested hundreds of millions of dollars in existing equipment and processes. “What they don’t want to do is scrap all that and jump to a new process, only to find out in 10 years there is an unintended consequence that no one had predicted,” he says.

One promising approach is the development of components that can be selectively added to existing production operations, minimizing the risk, says Nanda. Instead of hoping to completely make-over an entire industry like steel manufacturing, he says, the strategy is to ask: “Can you be part of the manufacturing process? Can you fit into an existing infrastructure?” From a practical perspective, he says, that often means offering modular solutions that existing industrial players can slot into their processes, with relatively little disruption.

Take Boston Metal, a startup that wants to transform global steel manufacturing. This industry accounts for almost a tenth of global carbon emissions and is rapidly growing in many parts of the globe. The company aims to replace the iconic blast furnace with an electrochemical process that turns iron ore into pure iron, an initial step in making steel. It’s an almost absurdly audacious goal: replacing a century-old technology that is the mainstay of one the world’s largest industries.

Boston Metal’s strategy is to try to make the transition as digestible as possible for steelmakers. “We won’t own and operate steel plants,” says Adam Rauwerdink, who heads business development at the company. Instead, it plans to license the technology for electrochemical units that are designed to be a simple drop-in replacement for blast furnaces; the liquid iron that flows out of the electrochemical cells can be handled just as if it were coming out of a blast furnace, with the same equipment.

Working with industrial investors including ArcelorMittal, says Rauwerdink, allows the startup to learn “how to integrate our technology into their plants—how to handle the raw materials coming in, the metal products coming out of our systems, and how to integrate downstream into their established processes.”

The startup’s headquarters in a business park about 15 miles outside Boston is far from any steel manufacturing, but these days it’s drawing frequent visitors from the industry. There, the startup’s pilot-scale electrochemical unit, the size of a large furnace, is intentionally designed to be familiar to those potential customers. If you ignore the hordes of electrical cables running in and out of it, and the boxes of electric equipment surrounding it, it’s easy to forget that the unit is not just another part of the standard steelmaking process. And that’s exactly what Boston Metal is hoping for.

The company expects to have an industrial-scale unit ready for use by 2025 or 2026. The deadline is key, because Boston Metal is counting on commitments that many large steelmakers have made to reach zero carbon emissions by 2050. Given that the life of an average blast furnace is around 20 years, that means having the technology ready to license before 2030, as steelmakers plan their long-term capital expenditures. But even now, says Rauwerdink, demand is growing for green steel, especially in Europe, where it’s selling for a few hundred dollars a metric ton more than the conventional product.

It’s that kind of blossoming market for clean technologies that many of today’s startups are depending on. The recent corporate commitments to decarbonize, and the IRA and other federal spending initiatives, are creating significant demand in markets “that previously didn’t exist,” says Michael Kearney, a partner at Engine Ventures.

One wild card, however, will be just how aggressively and faithfully corporations pursue ways to transform their core businesses and to meet their publicly stated goals. Funding a small pilot-scale project, says Kearney, “looks more like greenwashing if you have no intention of scaling those projects.” Watching which companies move from pilot plants to full-scale commercial facilities will tell you “who’s really serious,” he says. Putting aside the fears of greenwashing, Kearney says it’s essential to engage these large corporations in the transition to cleaner technologies.

Susan Schofer, a partner at the venture firm SOSV, has some advice for those VCs and startups reluctant to work with existing companies in traditionally heavily polluting industries: Get over it. “We need to partner with them. These incumbents have important knowledge that we all need to get in order to effect change. So there needs to be healthy respect on both sides,” she says. Too often, she says, there is “an attitude that we don’t want to do that because it’s helping an incumbent industry.” But the reality, she says, is that finding ways for such industries to save energy or use cleaner technologies “can make the biggest difference in the near term.”

Getting luckyIt’s tempting to dismiss the history of cleantech 1.0. It was more than a decade ago, and there’s a new generation of startups and investors. Far more money is around today, along with a broader range of financing options. Surely we’re savvier these days.

But it would be a mistake to ignore the past failures. The challenges of commercializing climate technologies rooted in advances in science and engineering remain the same: not only are they expensive and risky to scale up, but you’re aiming to compete in mature markets characterized by commodity products with low margins. The economics, despite what some Silicon Valley boosters might proclaim, haven’t changed.

Many of the technologies that we’re so excited about today could fail. Even as billions are flowing into green hydrogen and direct air capture, these technologies remain highly speculative and may prove too expensive to ever be competitive. Fusion might never be a working source of power. Some of the venture-backed startups that are pinning their hopes on green cement or steel could, like the advanced biofuels startups of the late 2000s, be gone in a few years. And that’s not even mentioning the plethora of early-stage startups with exotic technologies that gained funding in recent years and are little more than lab experiments with no discernible markets.

The most enduring lesson from cleantech 1.0 is a simple one: the survival of climate-tech startups depends on demand for their inventions from large and..