Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

About Me

Latinos Media

Latinos Media Latinos Media provides all types of news feeds on a daily basis to our Members

Posted by - Latinos Media -

on - March 28, 2023 -

Filed in - Financial -

-

612 Views - 0 Comments - 0 Likes - 0 Reviews

Is the recent stock market downturn a cause for concern? Well, it’s certainly hard to remain calm when the FTSE 100 is falling. However, I’m trying to keep a cool head and I’m aiming to use the sell-off as an opportunity to buy cheap shares.

Two Footsie shares that look attractive to me right now are medical products manufacturer ConvaTec Group (LSE:CTEC) and water utilities giant Severn Trent (LSE:SVT).

Let’s explore each in turn.

ConvaTec GroupConvaTec’s product range covers a variety of medical solutions from advanced wound care dressings to ostomy care devices and accessories. It’s a stable business, and relatively non-cyclical in the face of difficult macroeconomic conditions.

The ConvaTec share price has experienced marginally positive growth over 12 months, increasing 1.5%. The stock also sports a handy 2.3% dividend yield.

The company is geographically diversified, generating 53% of its sales in North America, 33% in Europe, and 14% in the rest of the world. Recent key performance indicators suggest the group is in good financial health.

Last year, revenue grew 6.9% to hit $2.07bn. In addition, the adjusted operating profit margin increased to 19.5%, up from 17.7% in 2021. ConvaTec hopes to boost the margin further to the mid-20s over the medium term.

Overall, I think the company’s growth looks sustainable, especially in the context of an aging population, which acts as a long-term tailwind. Plus, I like the group’s defensive credentials.

ConvaTec occupies leading positions in its various product markets. Its focus on chronic care conditions means revenues are often recurring in nature.

Granted, inflationary headwinds continue to pose risks due to the increased pressure on input costs. However, many central banks expect prices will fall as the year unfolds.

If I had some spare cash, I’d buy ConvaTec shares today.

Severn TrentThe Severn Trent share price has fallen 6% over the past year, but over five years it’s grown 48%. The stock offers shareholders a 3.7% dividend yield.

This is another company with robust financials. In recent interim results, the group confirmed its Regulated Water and Waste Water division is on track to deliver £1.97bn to £2.02bn in turnover, which means its full-year guidance is unchanged. This division is responsible for the lion’s share of the firm’s revenue.

In addition, total dividends per share are expected to rise to 106.82p from 102.14p in the previous financial year.

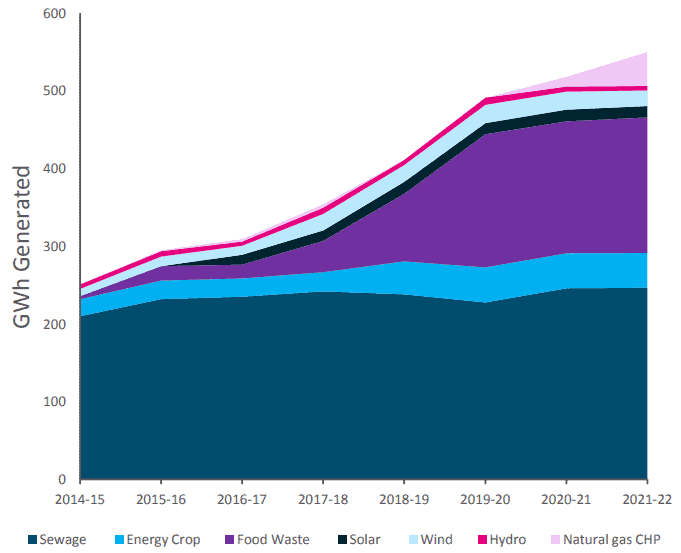

The business recently acquired Andigestion, a company that operates two food recycling plants. This deal boosts Severn Trent’s green credentials and enhances its power generation capabilities thanks to the additional 45GWh per year the food digestion operations will provide — a rise of 16%.

Source: Severn Trent Interim Results 2022/23

Source: Severn Trent Interim Results 2022/23

Severn Trent now self-generates over half of its energy consumption. That’s an attractive hedge against rising energy prices, which have caused difficulties for many companies over the past year.

A 6% uptick in net debt to £6.63bn in H1 2023 suggests there are risks, especially in the context of ambitious future infrastructure investment plans. However, the balance sheet looks sufficiently stable to me at present, although I’ll monitor any developments closely.

Overall, this looks like another solid defensive stock for me to invest in. If I had some spare cash, I’d buy Severn Trent shares today.

The post 2 cheap shares I’d buy as the FTSE 100 slides appeared first on The Motley Fool UK.

Inflation recently hit 40-year highs… the ‘cost of living crisis’ rumbles on… the prospect of a new Cold War with Russia and China looms large, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

setButtonColorDefaults("#5FA85D", 'background', '#5FA85D'); setButtonColorDefaults("#43A24A", 'border-color', '#43A24A'); setButtonColorDefaults("#ffffff", 'color', '#FFFFFF'); })()

More reading

Charlie Carman has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.