Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

About Me

Rodney Powel

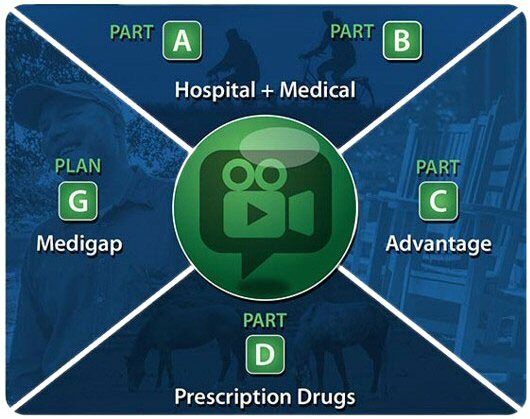

Rodney Powel MEDICARE Health Insurance | Medigap Supplements, Advantage Plans, Part D prescription drug coverage, and dental for seniors

Rodney Powel -

December 8, 2024 -

Health -

297 views -

0 Comments -

0 Likes -

0 Reviews

Rodney Powel -

December 8, 2024 -

Health -

297 views -

0 Comments -

0 Likes -

0 Reviews

When exploring healthcare options in retirement, many seniors come across a popular term: A list of Medicare Advantage plans that offer no monthly premium. Initially, one would think these plans present an irresistible bargain – a package of insurance and no monthly premiums. However, to be more aware of your options, knowing the cost of zero-premium Medicare Advantage plans is essential when considering enrollment, especially for Medicare Arizona.

These plans are taken as supplements to basic Medicare; Part A and Part B and offer additional benefits like vision, dental and hearing, and prescription drugs among others. However, what are these zero-premium plans is it really free, and is it any better than the other plans? Moreover, this paper will discuss elements such as the composition of the Medicare Advantage plans and other costs not transparent to the public, then finally establish whether these noble plans fulfill the needs of the retirees in Arizona.

What Are Zero-Premium Medicare Advantage Plans?

These are Medicare Part C plans known and offered by private insurance companies with zero premiums. These plan types differ from Original Medicare in that they include both hospital benefits (Part A) and medical benefits (Part B), as well as added benefits.

This means that the “zero-premium” does not refer to an additional monthly premium outside of what one will be paying to access Medicare Part B in 2024 being $164.90 for most of the beneficiaries. However, the non-existent of the premium doesn’t mean that the plan has no cost. It means that you still assume the potential of self-payments including copayments, deductibles, and coinsurance fees.

Self-funded plans make sense in Arizona because the needs may differ significantly depending on demography and weather, but you need to know their downsides.

The True Cost of Zero-Premium Plans

Zero-premium Medicare Advantage plans normally entice seniors with the possibility of paying nothing each month. But there are several areas where costs can quickly add up:

Medicare Advantage plans as defined follow an out-of-pocket maximum yearly allowed amount for all the covered services. In Arizona, the maximum of this payment can be as little as $3,000 or as much as over $8,000, depending on the plan.

If you need many doctor’s visits or prescription drugs or if you get sick enough to need to be hospitalized, you might go through that deductible and find that the zero-premium plan costs more.

Many of the zero-premium plans require enrollees to pay out of pocket for services including visits to a doctor, going to the emergency room, and drugs. For instance, a visit to a specialist may set a client back $35 per appointment whereas as an emergency the cost could get to well over $100.

In Arizona for instance, where people in their retirement ages might suffer from conditions such as heart disease which is worsened by the heat, or those with respiratory problems, such costs can quickly build up.

The majority of Medicare Advantage plans employ the use of provider networks, which means that you can only opt for physicians, specialists, and hospitals recognized by the plan for you to enjoy all the perks.

Unfortunately, it will be extremely difficult to find a provider that is in Arizona’s network if you live in a rural area or if you are on the move most of the time. Out-of-network care means that it costs you, the patient, a larger percentage of the bill or even the full amount.

The overwhelming majority of Medicare Advantage plans do cover prescription drugs but it may sometimes split these into tiers to show you the exact cost you will incur for your medication. Some of the drugs cost less but some are expensive brand drugs or specialty drugs could be very costly to the patients for out–of–pocket payment.

Whenever the people of Arizona need to take some maintenance medications for illnesses like arthritis or diabetes common amongst elderly people, it will be useful to know which medicines the plan has approved.

The Benefits of Medicare Advantage in Arizona

While there are potential costs, Medicare Advantage plans also come with notable benefits that make them attractive to Arizona residents:

Is a Zero-Premium Plan Right for You?

It should be understood that each applicant for a zero-premium Medicare Advantage plan should consider whether this plan will meet his or her needs and provide the necessary insurance based on the applicant’s circumstances.

Consider a Zero-Premium Plan If:

Think Twice If:

Final Thoughts on Medicare Arizona and Zero-Premium Plans

Some Medicare Advantage Plans are available for $0 premium as a result, they are ideal for retirees in Arizona since they provide ample, double Medicare coverage and extra features at no cost beyond the initial cost. However, society has to learn that when people talk about “zero premium” it doesn’t mean “zero cost.” Several obstacles such as cost that has to be paid from your pocket before being reimbursed, network limitations, and more make these plans a bit more costly than they look.

Read through each plan carefully to compare providers; out-of-pocket expenses such as co-pays, coinsurance, and deductible; and drug lists. One can also seek help from a Medicare advisor in Arizona to get the best plan that is suitable for you both in terms of healthcare requirements and cost.

With greater awareness of these additional expenses inherent in the MCO models of these zero-premium MA plans, you have a better shot at not being blindsided and being able to plan properly for your retirement healthcare.