Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

Matt Easterlin -

June 7, 2023 -

Business -

Meat Substitutes Market

-

780 views -

0 Comments -

0 Likes -

0 Reviews

Matt Easterlin -

June 7, 2023 -

Business -

Meat Substitutes Market

-

780 views -

0 Comments -

0 Likes -

0 Reviews

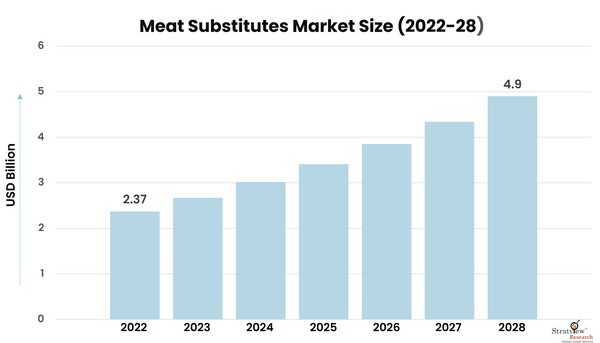

Stratview Research has published a new report on the Meat Substitutes Market. The report on the market is segmented by Source Type (Soy Protein, Wheat Protein, Pea Protein, and Others), by Product Type (Tofu, Tempeh, Seitan, Quorn, and Others), by Type (Concentrates, Isolates, and Textured), by Form Type (Solid, Liquid), and by Region (North America, Europe, Asia-Pacific, and Rest of the World).

Market Overview:

The meat substitutes market was estimated at USD 2.37 billion in 2021 and is likely to grow at a CAGR of 12.91% during 2023-2028 to reach USD 4.9 billion in 2028.

What is a meat substitute?

A meat substitute, also known as a meat alternative or mock meat, is a food product that is designed to replace the taste, texture, and nutritional profile of the meat. It is typically made from plant-based ingredients or other non-meat sources and can be used instead of meat.

The health benefits associated with these ingredients are almost similar to real meat, and this is a significant factor behind the rising demand for meat substitutes.

COVID-19 IMPACT

There was a spike in the sales of meat substitutes in 2020, increasing sales as compared to 2019. The disruption in the supply chain of the meat market due to the Covid-19 pandemic positively impacted the meat substitutes market. Hence notable growth in the market was observed in the year 2020.

Market Dynamics

Surging Demand for Plant-derived Proteins: Over the past decade, there has been a remarkable upswing in the global market for protein derived from plants. Traditionally, a significant portion of the population in Europe and North America relied heavily on meat-based protein for their daily nutritional requirements. However, the abundant cholesterol content in meat proteins, known to be associated with various health concerns, has prompted a shift in consumer preferences. This shift has been particularly pronounced in industrialized nations like the United States, Germany, France, and the United Kingdom, where there has been a substantial increase in the adoption of plant-based protein foods. Notably, regions such as the US and the UK have witnessed a noteworthy rise in the number of vegans, with an astonishing 600% increase in the US vegan population in the past three years, as reported by the Food Revolution Organization in 2018. This growing inclination towards plant-based proteins is poised to drive the expansion of the meat substitutes market.

According to the Good Food Institute, the percentage of American families purchasing plant-based meat increased from 10.5% in the previous year to 11.9% in 2019. Furthermore, in December 2021, Next Meats, a Tokyo-based company, joined forces with Vegan Meat India to introduce meat-free products in the country. This diverse range of offerings not only provides consumers with a wider array of options and innovative flavors but also ensures the fulfillment of their dietary requirements.

Revolutionary Technological Innovations Enhance Plant-based Protein Opportunities: The continuous advancements in extrusion and processing technologies are poised to revolutionize the landscape of the meat substitute market. The pivotal role played by processing becomes evident as it involves the extraction of essential plant-based proteins like pea protein, soy protein, and wheat protein. Conventional dry extraction techniques typically yield protein flour with protein content ranging from 20% to 40% and concentrates with protein content ranging from 46% to 60%. However, the introduction of novel extrudable fat technology, acquired from Coasun, has unlocked new possibilities. This groundbreaking technology replicates animal fat, enabling the creation of more authentic fat textures, including marbling, in plant-based meats. By running fat through an extruder and skilfully combining it with protein, this innovative approach results in a superior ingredient where the fat and protein are seamlessly integrated. Additionally, the adoption of Prolamin technology, licensed from the University of Guelph, has revolutionized plant-based meat production. This technology harnesses plant-based ingredients to enhance the texture of plant-based cheese, allowing it to melt, bubble, and stretch akin to its animal-derived dairy counterparts.

Transformative Health and Environmental Impact of Plant-based Protein Consumption: The consumption of red meat has long been associated with a multitude of health disorders. Extensive research conducted by the Harvard School of Public Health in September 2019 highlights the increased risk of diabetes, cardiovascular diseases, cancers, and other serious illnesses among consumers of red meat. Consequently, health-conscious individuals are increasingly replacing red meat with plant-based protein alternatives like tofu, tempeh, seitan, and defatted soy chunks, among other meat-like protein products. Such dietary shifts are anticipated to significantly reduce the risk of obesity and various health ailments while simultaneously enhancing the overall quality of life for consumers.

Segment Analysis

Based on the source type, the market is segmented as soy protein, wheat protein, pea protein, and others. The soy protein segment is expected to be the largest segment, during the forecast period, due to the high demand for soy-based meat alternative products, such as pork, beef, and chicken, on account of their high protein content.

Based on the type, the market is segmented as concentrates, isolates, and textured. The concentrates segment is expected to be the fastest-growing segment due to its low price and high protein content.

Based on the form type, the market is segmented as solid and liquid. The solid segment is expected to remain the larger segment of the market during the forecast period owing to its ability to preserve the flavor and color of food products.

In terms of regions, Asia-Pacific is estimated to be the fastest-growing market during the forecast period. Awareness for animal welfare, health benefits, cost affordability, and a growing variety of meat substitute products are driving the market in the region with China and India as the growth engines.

What do we aim to solve with this report?

By delivering concise and pertinent industry information & outlook, we aim to assist the stakeholders in navigating through the decision-making terrain.

The report primarily aims at:

- Helping the user recognize innovative trends surrounding the Meat Substitutes Market.

- Finding out factors that assist the user in making practical business decisions.

- Highlighting the positive & negative influencers of the Meat Substitutes Market.

- Forecasting the sales, CAGR, and the dominant segments & sub-segments of the market.

- Analysing the key players/competitors in the market.

Key Players

Critical Questions Answered in the Report

Custom Research: Stratview research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please connect with our team at :

+1-313-307-4176.