Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

bukhari syed -

May 24, 2023 -

Business -

malir town residency payment plan

-

489 views -

0 Comments -

0 Likes -

0 Reviews

bukhari syed -

May 24, 2023 -

Business -

malir town residency payment plan

-

489 views -

0 Comments -

0 Likes -

0 Reviews

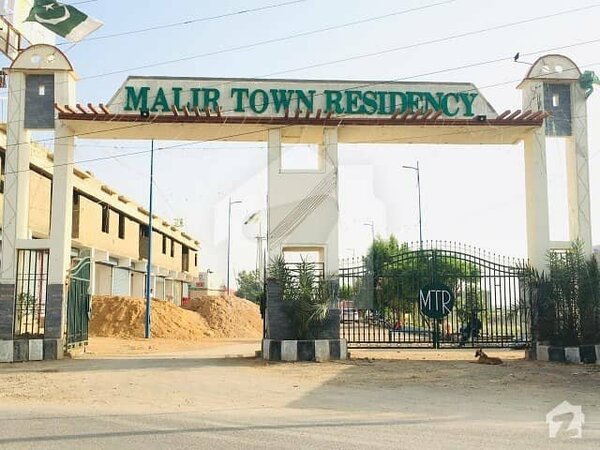

Are you in search of a comfortable residence in the bustling city of Karachi? Look no further than Malir Town Residency! This luxurious housing scheme offers state-of-the-art facilities and amenities, making it an ideal choice for property buyers. However, with multiple payment plans available, choosing the right one can be daunting. In this blog post, we'll delve into the pros and cons of Malir Town Residency's payment plans so that you can make an informed decision when purchasing your dream home. So let's get started!

Malir Town Residency offers various payment plans for potential property buyers. These plans are designed to provide flexibility and convenience to those who wish to invest in a residence within the housing scheme. The payment plans essentially allow you to pay for your property over an extended period, making it easier for you financially.

The different types of Malir Town Residency Payment Plans offer varying terms that cater to unique financial circumstances. For example, some plans require a down payment while others don't. Similarly, some require monthly instalments while others have bi-annual or annual instalment options.

By opting for a Malir Town Residency Payment Plan, you can avoid the hassle of paying all at once and instead break up payments into manageable amounts over time. This is particularly beneficial if you're on a tight budget or aren't able/willing to make full payments upfront.

However, it's important to choose the right plan based on your financial situation and preferences as each plan has its pros and cons. In the next section of this blog post, we'll discuss these pros and cons in detail so that you have all the information necessary before investing in Malir Town Residency.

When it comes to investing in property, one of the most critical aspects that buyers consider is the payment plan. The Malir Town Residency offers different types of payment plans to cater to varying needs and financial capabilities of potential property buyers.

One option available is a full cash payment plan that requires paying the total amount upfront. This payment type comes with discounts and reduced rates for buyers who can afford such an arrangement.

Another option is a flexible installment plan that allows property investors to spread their payments over time comfortably. This approach usually involves regular monthly or quarterly payments for several years until they complete the entire purchase price.

For those looking for more extended repayment periods, there's also a deferred payment scheme offered by Malir Town Residency. In this setup, a buyer pays only a small percentage as downpayment at first then spreads out remaining balance over many years while paying interest on outstanding debt.

These different types of payment plans provide flexibility and options for potential buyers in making their investment decisions based on personal preferences and financial capabilities.

When considering purchasing property in Malir Town Residency, it's important to weigh the pros and cons of their payment plans. One advantage is that these payment plans allow buyers to spread out their payments over a longer period of time, making it more affordable for those who might not have the funds available upfront.

Another benefit is that Malir Town Residency offers different types of payment plans, such as installment plans and down payments with monthly installments. This provides flexibility for buyers to choose a plan that best fits their financial situation.

However, there are also drawbacks to consider when choosing a payment plan. For example, interest rates may be higher compared to paying in full upfront. Additionally, if you miss a payment or default on your plan, there may be penalties or legal consequences.

It's also important to note that some payment plans require larger down payments or additional fees compared to others. Buyers should carefully review all details and terms before committing to any particular plan.

While Malir Town Residency's payment plans offer benefits such as affordability and flexibility, buyers must carefully consider the potential drawbacks before making a decision.

If you're interested in purchasing a property at Malir Town Residency, it's essential to know the requirements for their payment plan.

Firstly, you must be a Pakistani citizen or have dual nationality. Additionally, your age should be between 18 and 65 years old. You must also provide proof of income through bank statements or tax returns.

Furthermore, if you're self-employed, you'll need to provide additional documentation such as business registration and financial statements. It's crucial to note that all applicants will undergo a credit check before being approved for the payment plan.

Another requirement is that the property can only be used for residential purposes; any commercial use may result in legal action against the buyer.

There are specific documents required when applying for a payment plan such as CNIC copies, booking forms, photographs and pay orders or demand drafts made out to Malir Town Residency.

Meeting these requirements is necessary to qualify for Malir Town Residency Payment Plan.

Applying for a Malir Town Residency Payment Plan is fairly simple. The first step is to visit the developer's office or website to get information about available payment plans. Once you have decided on a plan that suits your budget, you can proceed with the application process.

The next step would be to fill out an application form and provide all necessary documents such as ID card, passport size photographs and proof of income. These requirements may vary depending on the specific payment plan selected.

After submitting your application, it will undergo review by the relevant authorities who will assess your eligibility based on factors including creditworthiness and income level. This process can take several days or even weeks so patience is key.

If your application is approved, you'll receive a letter of acceptance outlining the terms and conditions of the payment plan. Make sure to read through this carefully before signing anything.

Once all paperwork has been completed and submitted along with initial payments (if any), you'll be ready to move forward with securing your dream property in Malir Town Residency!

If the Malir Town Residency Payment Plan doesn't seem like the right fit for you, there are alternatives to consider before making your final decision.

One alternative is to look into other payment plans offered by real estate developers in the area. Many developers have their own unique payment plans that may better suit your financial situation and goals.

Another option is to take out a bank loan specifically for purchasing property. This can allow you more flexibility in terms of payment timelines and interest rates. However, it's important to do thorough research on different banks and their loan options before committing to one.

You could also consider investing in a property crowdfunding platform or joining a real estate investment group. These options can provide lower upfront costs while still allowing you the opportunity to invest in property and potentially earn returns over time.

Ultimately, it's important to carefully evaluate all of your options and weigh their pros and cons before deciding which path is best for you.

To sum it up, the Malir Town Residency payment plan is a convenient way for property buyers to invest in their dream home. It offers various options that cater to different financial capabilities and requirements.

While there are advantages such as flexibility, ease of payment, and affordability, there are also downsides like higher overall cost due to interest charges and possible risks involved with delayed payments.

As a potential buyer considering this payment plan or any other alternative plans out there, it's important that you carefully weigh your options based on your budget, financial goals and future projections before making a decision.

The Malir Town Residency Payment Plan can be a suitable option for those who want to own property in Karachi without the burden of immediate full payments. But ultimately only you know what works best for your unique situation.