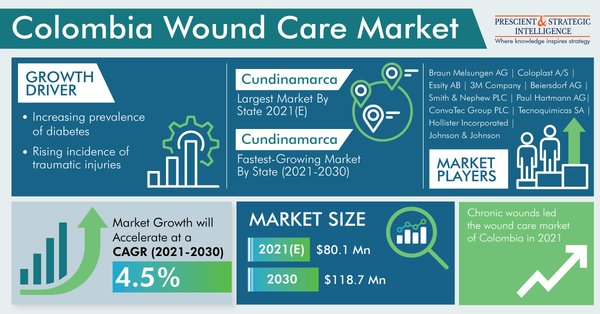

A number of factors, such as the increasing geriatric population, soaring incidence of traumatic injuries, rising prevalence of diabetes, and expanding healthcare coverage, are expected to drive the Colombian wound care market at 4.5% CAGR between 2021 and 2030. The market was valued at $80.1 million in 2021, and it is projected to generate $118.7 million revenue by 2030. In recent years, the growing preference for advanced therapies over traditional wound care products has become a prominent market trend.

The growing prevalence of diabetes will steer the demand for wound care products in Colombia due to the rising incidence of diabetic foot ulcers in diabetic patients. According to the International Diabetes Federation, 2,836,500 adults were living with diabetes in Colombia in 2020, accounting for nearly 8.4% of the adults in the country. The surging cases of diabetes can be ascribed to the accelerating urbanization rate, soaring cases of obesity, declining fertility rate, and booming aging population.

Moreover, the rising elderly population will also steer the Colombian wound care market growth in this decade. As geriatric people are highly prone to chronic wounds, they require wound care products in abundance. As per the AgeWatch report card of HelpAge.org, approximately 27.6% of the Colombian population will be aged over 60 years of age by 2050. Furthermore, the 2018 WHO data on life expectancy in Colombia reveals that the life expectancy of men and women in the country is 71.5 years and 78.8 years, respectively.

In 2021, the chronic wounds category generated higher revenue in the Colombian wound care market, under the wound type segment. The dominance of this category can be attributed to the surging cases of diabetic foot ulcers (DFUs), owing to the expanding pool of diabetic patients, pressure ulcers, and fungating wounds. The IDF forecasts that the population of diabetic patients in the South and Central American (SACA) region will reach 49 million by 2045.

At present, the Colombian wound care market is highly competitive, with the presence of numerous players, such as 3M Company, B. Braun Melsungen AG, ConvaTec Group PLC, Coloplast A/S, Essity AB, and Integra LifeSciences Holdings Corporation. Nowadays, the market players are involved in mergers and acquisitions and product launches to gain a competitive edge. For instance, in January 2021, Integra LifeSciences Holdings Corporation completed the acquisition of ACell Inc. and its proprietary MatriStem UBM technologies. With this move, Integra aimed to provide more comprehensive solutions for managing complex wounds.

According to P&S Intelligence, Cundinamarca accounted for the largest share in the Colombian wound care market in 2021, and it will retain its dominance throughout this decade. The dominance of this state can be credited to the increasing number of big clinics and hospitals and the surging number of surgical procedures. Furthermore, the city of Bogota generates the highest demand for wound care products in the country due to the presence of Joint Commission International (JCI)-accredited hospitals, easy access to healthcare services, and the existence of a large population.

Thus, the increasing cases of diabetes and the growing geriatric population will augment the demand for wound care products in Colombia.