Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

About Me

Abby Miller

Abby Miller Abby Miller story begins in a small town, where her love for art and creativity started at an early age. She spent her childhood surrounded by paints, pencils, and a deep appreciation for the beauty in the world. Her parents were a significant influence on her, encouraging her to explore her artistic talents and embrace her inner creativity.

Abby Miller -

September 25, 2024 -

Health -

Accounts Receivable

CashFlowManagement

Financial Management

Debt Collection

AR Management

Receivables Management

Networth RCM

Accounts Receivable Management Company

-

330 views -

0 Comments -

0 Likes -

0 Reviews

Abby Miller -

September 25, 2024 -

Health -

Accounts Receivable

CashFlowManagement

Financial Management

Debt Collection

AR Management

Receivables Management

Networth RCM

Accounts Receivable Management Company

-

330 views -

0 Comments -

0 Likes -

0 Reviews

Managing accounts receivable (AR) is crucial for the financial health of any business. When effectively managed, it ensures a steady cash flow, reduces the risk of bad debts, and strengthens relationships with clients. This blog explores the functions, benefits, and importance of partnering with an accounts receivable management company.

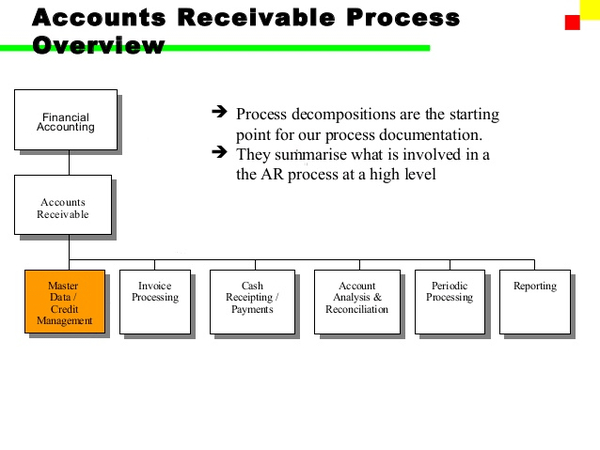

Accounts receivable management refers to the process of overseeing and optimizing the outstanding payments due from customers. This involves tracking invoices, following up on payments, and managing any disputes or collections. Companies often struggle with AR management due to resource constraints, lack of expertise, or inefficient processes, making outsourcing to a specialized AR management company an attractive solution.

An AR management company ensures that invoices are generated, sent, and tracked promptly. They can set up automated systems to manage recurring invoices, reducing the chance of missed payments.

Timely follow-up on overdue accounts is essential. AR companies employ dedicated teams to contact customers and remind them of their outstanding balances, utilizing various communication methods (emails, calls, or letters) to ensure payment.

Before extending credit to customers, AR management companies can perform credit checks to evaluate the risk associated with potential clients. This minimizes the chances of extending credit to high-risk customers, ultimately protecting the company’s cash flow.

Conflicts over invoices can arise, leading to delayed payments. An AR management company can effectively handle these disputes, facilitating communication between parties to resolve issues quickly and amicably.

If payments remain unpaid for an extended period, an accounts receivable management company can escalate the situation through a structured collections process. This includes negotiating payment plans and, if necessary, involving collection agencies.

Accounts receivable management companies provide regular reports and analytics on the company's receivables. These insights can help businesses understand their cash flow, identify trends, and make informed decisions to improve financial management.

By ensuring timely invoicing and follow-up, AR management companies help businesses maintain a consistent cash flow. This is vital for covering operational expenses and funding growth initiatives.

Outsourcing AR management can be more cost-effective than maintaining an in-house team. Companies can save on salaries, training, and overhead costs while still benefiting from expert services.

By outsourcing AR management, businesses can focus on their core functions, such as sales and customer service. This can lead to increased productivity and growth opportunities.

AR management companies specialize in managing receivables. Their expertise can lead to better collection rates and more effective management strategies, which may be difficult for in-house teams to achieve.

Partnering with an AR management company can help mitigate the risks associated with bad debts. By assessing credit risks and managing collections, businesses can protect their bottom line.

When selecting an AR management company, consider the following factors:

Experience and Reputation: Look for a company with a proven track record and positive reviews from clients in your industry.

Technology and Tools: Ensure the company utilizes advanced technology and tools for efficient management and reporting.

Customization: Choose a provider that can tailor their services to meet your specific needs and challenges.

Compliance: Ensure the company follows all relevant regulations and industry standards to protect your business from potential legal issues.

Communication: Effective communication is crucial for successful AR management. Choose a company that emphasizes transparency and regular updates.

In today's competitive business landscape, effective accounts receivable management is vital for maintaining a healthy cash flow and minimizing financial risks. Partnering with an experienced accounts receivable management company can provide numerous benefits, including improved efficiency, cost savings, and access to specialized expertise. By outsourcing this critical function, businesses can focus on their core operations and drive growth while ensuring their receivables are managed effectively. If you’re considering outsourcing your accounts receivable management, take the time to research and find a partner that aligns with your business goals and values.