Notifications

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

ALL BUSINESS

COMIDA

DIRECTORIES

ENTERTAINMENT

FINER THINGS

HEALTH

MARKETPLACE

MEMBER's ONLY

MONEY MATTER$

MOTIVATIONAL

NEWS & WEATHER

TECHNOLOGIA

TV NETWORKS

VIDEOS

VOTE USA 2026/2028

INVESTOR RELATIONS

COMING 2026 / 2027

About Me

Jack Rained

Jack Rained At Professionals Learning, we aim to succeed through efficiency and essential skills. Our Regulatory Compliance Training and top-tier online courses, complete with certifications, are designed to help professionals and organizations stay competitive and compliant. We offer certifications such as HRCI, SHRM, and NASBA to each of our attendees. Our programs are led by experts, and we offer flexible learning options, where you can progress at your own pace and luxury. Join us today to elevate your career and achieve your professional goals.

Jack Rained -

May 29 -

Other -

#education

form 1099-misc

professional training

IRS mistakes

-

106 views -

0 Comments -

0 Likes -

0 Reviews

Jack Rained -

May 29 -

Other -

#education

form 1099-misc

professional training

IRS mistakes

-

106 views -

0 Comments -

0 Likes -

0 Reviews

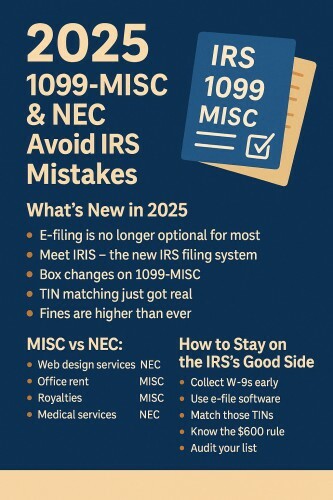

If the phrase “IRS form 1099” makes your stomach flip — take a deep breath. You’re not alone.

Whether you're a small business owner, a bookkeeper, or the person your boss roped into handling tax season this year, the truth is this: 1099 forms are tricky, and in 2025, the IRS just added a few more curveballs.

Don’t worry — we’re breaking it all down for you. In plain English. With no confusing tax-jargon.

Let’s help you avoid fines, fix those common mistakes, and maybe even feel a bit more confident about this whole 1099 thing.

Think of it like this: If you pay someone who isn’t your employee — a freelancer, a contractor, or even your landlord — you’ve probably got to tell the IRS about it. That’s what IRS form 1099 is for.

There are several flavors of this form, but two of them matter most in 2025:

Here’s what the IRS has rolled out in 2025. Spoiler: It’s more than just a new box to check.

📌 E-filing is now required if you file 10 or more total forms

That includes all your 1099s, W-2s, and other info returns. If you’re filing by paper and you’ve got more than 10 to send? That’s a no-go. You’ll need to file electronically.

🖥️ The IRS has a new e-filing system (and it’s actually user-friendly!)

Say hello to IRIS — the Information Returns Intake System. It’s replacing the old, clunky FIRE system and makes it easier to e-file your forms for free.

✏️ Box updates on Form 1099-MISC

Some boxes have new labels or purposes. If you’re using last year’s template, it could land you in hot water. Time to download the updated version and double-check everything.

✅ TIN Matching isn’t optional anymore

If the Taxpayer Identification Number (TIN) on your form doesn’t match what the IRS has on file, you’ll get a lovely CP2100 notice in the mail (which no one wants). Use the free TIN Matching Tool from the IRS before you file.

💸 Penalties have gone up — again

Late or incorrect filings can cost up to $310 per form. Multiply that by a few contractors and… yeah. That vacation fund just became an IRS donation.

Here’s the rule of thumb:

If you’re paying for services? → 1099-NEC

Paying rent, royalties, or medical expenses? → 1099-MISC

Here’s a handy cheat sheet:

|

What You Paid For |

Use This Form |

Box to Fill |

|

Graphic design work |

1099-NEC |

Box 1 |

|

Office rent |

1099-MISC |

Box 1 |

|

Royalties for content |

1099-MISC |

Box 2 |

|

Legal fees |

1099-NEC |

Box 1 |

|

Health/medical services |

1099-MISC |

Box 6 |

Still not sure? When in doubt, ask yourself: "Was I paying someone to DO something?" If yes → it's probably 1099-NEC.

❌ Mistake #1: Using the wrong form

Contractor payments go on 1099-NEC, not MISC. That changed in 2020, but some folks still haven’t caught on.

❌ Mistake #2: Filing late

You’ve got until January 31, 2025, to send out 1099s. That’s the deadline for both giving a copy to your contractor and filing with the IRS.

❌ Mistake #3: Incorrect TINs

A single typo in a TIN can trigger IRS notices. Use the TIN matching tool before filing. It’s free and lifesaving.

❌ Mistake #4: Forgetting your state

Some states require a separate 1099 filing. Don’t assume the IRS handles it all. They don’t.

❌ Mistake #5: Skipping the contractor copy

You must send your contractor their 1099 — not just file it with the IRS. This is often missed in small businesses.

✅ Collect W-9s Before You Pay Anyone

Seriously, get the W-9 before you even think of paying someone. No W-9 = you don’t have their legal name or TIN.

✅ Use Accounting Software That Files for You

QuickBooks, Gusto, and Wave all let you auto-file 1099s. Save yourself the drama.

✅ Start Sooner Than You Think You Should

1099s sneak up on everyone. Don’t be the person doing this on January 30 at 11:57 p.m.

✅ Create a Filing System for Contractors

Use spreadsheets, folders, or even sticky notes. Just don’t wing it.

✅ Know the $600 Rule

If you paid someone $600 or more during the year for services (not goods), you must file a 1099-NEC.

Do I need to file a Form 1099-NEC for someone I paid through PayPal or Venmo?

Only if you paid them “off the record” or as “friends and family.” If it went through a business account, PayPal will issue a 1099-K instead.

Can I still handwrite my 1099s?

Yes, if you’re filing fewer than 10 total forms. But for most businesses? It's time to e-file.

What if I made a mistake after filing?

You can submit a corrected 1099. Just check the “Corrected” box and refile ASAP.

Do I send the 1099 to the contractor or the IRS first?

Doesn’t matter which is first — but both need it by January 31.

Look, tax stuff isn’t exactly thrilling — but it doesn’t have to be stressful either.

With a few smart moves and a little early prep, you can dodge fines, file accurately, and actually feel good about wrapping up your 1099s this year.

So don’t wait. Double-check your forms. Update your filing process. And for the love of caffeine — start now, not later.